National Stores Corporation is one of the largest owners of discount appliance stores in the United States.

Question:

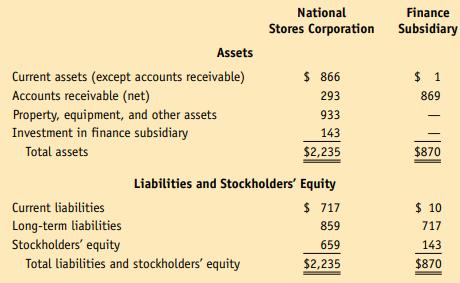

National Stores Corporation is one of the largest owners of discount appliance stores in the United States. It owns Bi-Lo Superstores and several other discount chains. It has a wholly owned finance subsidiary handle its accounts receivable. Condensed balance sheets for National Stores and its finance subsidiary are shown below (in millions). The fiscal year ends January 31, 20x7.

Total sales to customers were $4 billion. The FASB requires all majorityowned subsidiaries to be consolidated in the parent company’s financial statements. National Stores’ management believes it is misleading to consolidate the finance subsidiary because it distorts the real operations of the company 1. Prepare a consolidated balance sheet for National Stores Corporation and its finance subsidiary.

2. Demonstrate the effects of consolidating by computing the following ratios for National Stores before and after the consolidation in 1: receivable turnover, days’ sales uncollected, and debt to equity ratio (use year-end balances).

3. What are some of the other ratios that will be affected by consolidating the financial statements? Does consolidation assist investors and creditors in assessing the risk of investing in National Stores’ securities or lending the company money? Relate your answer to your calculations in 2.

4. What do you think of management’s view that it is misleading to consolidate the finance subsidiary?

Decision Analysis Using Excel Accounting for Short-Term Investments

Step by Step Answer: