On December 31, 2010, Cohen and Company prepared an income statement and a statement of financial position

Question:

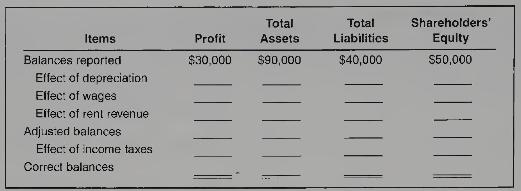

On December 31, 2010, Cohen and Company prepared an income statement and a statement of financial position but failed to take into account four adjusting entries. The income statement, prepared on this incorrect basis, reflected pretax profit of \(\$ 30,000\). The statement of financial position (before the effect of income taxes) reflected total assets, \(\$ 90,000\); total liabilities, \(\$ 40,000\); and shareholders' equity, \(\$ 50,000\). The data for the four adjusting entries follow:

a. Depreciation for the year on equipment that cost \(\$ 75,000 \mathrm{was}\) not recorded. The equipment's useful life is 10 years and its residual value is \(\$ 5,000\).

b. Wages amounting to \(\$ 17,000\) for the last three days of December 2010 were not paid and not recorded (the next pay date is January 10, 2011).

c. An amount of \(\$ 4,500\) was collected on December 1,2010 , for rental of office space for the period December 1,2010 , to February 28,2011 . The \(\$ 4,500\) was credited in full to deferred rent revenue when collected.

d. Income taxes were not recorded. The income tax rate for the company is 30 percent.

Required:

Complete the following tabulation to correct the financial statements for the effects of the four errors (indicate deductions with parentheses):

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby