PURCHASES, SALES, AND COST OF GOODS SOLD. The following data were available for Jeans Inc., a seller

Question:

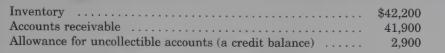

PURCHASES, SALES, AND COST OF GOODS SOLD. The following data were available for Jeans Inc., a seller of denim clothing, at January 1 of a recent year:

Jeans Inc. records purchases and sales gross. During the year, Jeans Inc. engaged in the following transactions:

a) Sold merchandise for $220,000 cash.

b) Sold merchandise on credit: list price $378,000; terms 3/10, n/20.

c) Granted a sales allowance on a credit sale in the amount of $2,400.

d) Collected cash from accounts receivable in the amount of $394,100. Of that amount, $364,235 was collected within the discount period (representing gross sales of $375,500) and $29,865 was collected after the discount period ended.

e) Wrote off accounts receivable in the amount of $2,730.

f) Purchased merchandise at a list price of $371,500. Terms were 2/10, n/30.

g) Returned merchandise with a recorded cost of $1,650.

h) Paid the account payable in full with a cash payment of $364,470. Of that amount, $344,470 was paid within the discount period (representing gross sales of $351,500)

and $20,000 was for accounts paid after the discount period.

i) Uncollectible account expense was estimated to be .9% of net credit sales.

REQUIRED:

1. Prepare journal entries for these transactions. Assume a periodic inventory system.

(Hint: Uncollectible account expense will be affected by the amount of sales discounts and sales allowances.)

2. Compute cost of goods sold and gross margin. Assume that ending inventory was $30,000. lol

Step by Step Answer: