Rogers Communications Inc. is a diversified Canadian communications and media company engaged in wireless, cable, and media

Question:

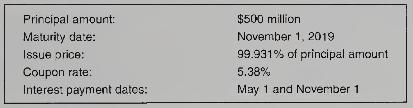

Rogers Communications Inc. is a diversified Canadian communications and media company engaged in wireless, cable, and media communications. On November 1, 2009, Rogers sold notes with the following specifications:

The underwriters (Scotia Capital Inc., RBC Dominion Securities Inc., BMO Nesbitt Burns Inc., TD Securities Inc., and CIBC World Markets Inc.), which sold these notes to investors, received an underwriting fee of \(\$ 2,000,000\) and remitted to the company the net proceeds of \(\$ 497,655,000\) from the sale of these notes. The effective interest rate on these notes is 5.389 percent.

\section*{Required:}

1. Prepare a journal entry to record the sale of these notes on November 1, 2009.

2. Compute the interest expense that accrued from November 1, 2009, to December 31, 2009, the end of Rogers' fiscal year, and prepare the adjusting journal entry on December 31, 2009, to record interest expense and amortization of the discount on the notes. The company uses the effective interest method of amortization.

3. Prepare the journal entry to record the payment of interest and amortization of the discount on May \(1,2010\).

4. Show the amounts that should be reported on Rogers' financial statements for the year 2009.

5. Compute the total amount of interest expense over the life of the notes.

6. After looking at the issue price, a student asked why Rogers did not simply sell the notes at 100 percent of the principal amount instead of selling them at a discount. How would you respond to this question?

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby