RONA operates a large network of franchised, affiliated, and corporate stores of various sizes and formats. The

Question:

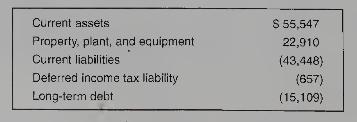

RONA operates a large network of franchised, affiliated, and corporate stores of various sizes and formats. The notes to the company's financial statements for the year 2005 indicate that it acquired the outstanding shares of TOTEM Building Supplies Ltd. (TOTEM) on April 1, 2005. The purchase price was \(\$ 96,400,000\) and the fair market value of identifiable assets acquired and liabilities assumed are as follows (in thousands of dollars):

Required:

1. Compute the amount of goodwill resulting from the purchase.

2. Compute the adjustments that RONA would make at the end of its fiscal year, December 31, 2005 , for depreciation or amortization of all long-lived assets (straight line), assuming an estimated remaining useful life of 10 years and no residual value. The company does not amortize goodwill.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby