Scoresby Inc. uses a perpetual inventory system. At December 31, 2012, the company's accounting records provided the

Question:

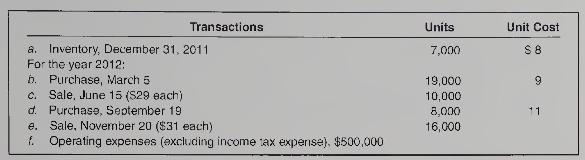

Scoresby Inc. uses a perpetual inventory system. At December 31, 2012, the company's accounting records provided the following information for Product B:

Required:

1. Prepare an income statement for 2012 through pretax profit, showing the detailed computation of cost of sales for two cases:

a. Case A-FIFO

b. Case B-Weighted average For each case, show the computation of the ending inventory. (Hint: Set up adjacent columns, one for each case.)

2. Compare the two cases with regard to the pretax profit and the ending inventory amounts. Explain the similarities and differences.

3. Which inventory costing method may be preferred for income tax purposes? Explain.

4. Prepare journal entries to record transactions

(b) through (e), assuming that Scoresby uses FIFO for inventory costing.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby