Selected accounts from the ledger of Aspen Sports for the current fiscal year ended June 30, 2008,

Question:

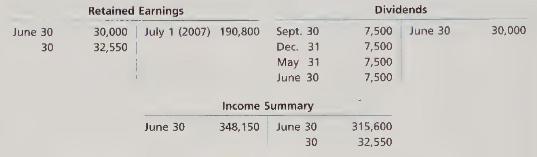

Selected accounts from the ledger of Aspen Sports for the current fiscal year ended June 30, 2008, are as follows:

Prepare a retained earnings statement for the year.objs. 2,3

Transcribed Image Text:

Retained Earnings Dividends June 30 30 30,000 32,550 July 1 (2007) 190,800 Sept. 30 7,500 June 30 30,000 Dec. 31 7,500 May 31 7,500 June 30 7,500 Income Summary June 30 348,150 June 30 315,600 30 32,550

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

Parvesh Kumar

I am an experienced Mathematics and Statistics tutor with 10 years of experience teaching students and working professionals. I love teaching students who are passionate to learn subjects or wants to understand any mathematics and statistics concept at graduation or master’s level. I have worked with thousands of students in my teaching career. I have helped students deal with difficult topics and subjects like Calculus, Algebra, Discrete Mathematics, Complex analysis, Graph theory, Hypothesis testing, Probability, Statistical Inference and more. After learning from me, students have found Mathematics and Statistics not dull but a fun subject. I can handle almost all curriculum of mathematics. I did B.Sc (mathematics), M.Sc (mathematics), M.Tech (IT) and am also Gate (CS) qualified. I have worked in various college and school and also provided online tutoring to American and Canadian students. I look forward to discussing with you and make learning a meaningful and purposeful

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Financial Accounting

ISBN: 9780324380675

10th Edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

Question Posted:

Students also viewed these Business questions

-

Explain what value there may be in fictionalizing the Netflix show Inventing Anna and in turn how it might explain or illustrate the communicative value and purpose of art. I nclude a discussion of...

-

Selected accounts from the ledger of Aspen Sports for the current fiscal year ended June 30, 2008, are as follows: Prepare a statement of owners equity for theyear. Tammy Eddy, Capital Tammy Eddy,...

-

Selected accounts from the ledger of Bobcat Sports for the current fiscal year ended August 31, 2006, are as follows: Prepare a retained earnings statement for theyear. RETAINED EARNINGS 16,000 Bal.,...

-

Kenny operates a store, where he sells feed and other supplies to farmers. Heather purchases a $20,000 tractor from Kenny and pays Kenny with $18,000 in cash and $2,000 in corn. How much gross income...

-

In Problem 7, Set 8.1a, suppose that production strives to meet the quota for the two products, using overtime if necessary. Find a solution to the problem, and specify the amount of overtime, if...

-

Toni Graff, Ahmad Nu, and Lindsay Pane are partners in Travel Essentials. Their partnership agreement stated that withdrawals would be 10 percent for each partner based on the partnerships net...

-

How does the information in a cover letter differ from the information in a rsum?

-

Bills Wrecker Service has just completed a minor repair on a tow truck. The repair cost was $1,550, and the book value prior to the repair was $6,500. In addition, the company spent $12,000 to...

-

Company Inc. owned the following business operations for all or part of the current year. 3 warehouses: Northern, Western, and Eastern. a retail store an amusement park a music recording studio Note:...

-

Identify each of the following as (a) a current asset or (b) property, plant, and equipment: 1. Accounts receivable 4. Equipment 2. Building 5. Prepaid insurance 3. Cash 6. Supplies objs. 2,3

-

Icon Systems Co. offers its services to residents in the Pasadena area. Selected accounts from the ledger of Icon Systems Co. for the current fiscal year ended August 31, 2008, are as follows:objs....

-

Fireplaces Etc. is about to launch a new range of wood stoves, priced at $110 per unit. The unit cost of the wood stoves is $65. The firm expects to sell the wood stoves over the next 5 years. The...

-

This case study is based on a fictional character on NBC's The Office. Michael is the central character of the series, serving as the Regional Manager of the Scranton branch of a paper distribution...

-

What is the significance of a balance sheet in understanding a firm's financial position? How do changes on the right side of the balance sheet (liabilities and equity) impact a company's financial...

-

A current event analysis where the article must focus on a management concepts). You will read the article and then provide an analysis of the subject matter discussed. The article should complement...

-

Given an exponential distribution with =20, what is the probability that the arrival time is a. less than X=0.2? b. greater than X = 0.2? c. between X=0.2 and X 0.3? d. less than X=0.2 or greater...

-

Choose at least two measures of employee attitudes. Discuss them and tell me about your discussion. Which group you believe are the most effective and efficient measures? Why? 2) Discuss turnover,...

-

USA Airlines uses the following performance measures. Classify each of the performance measures below into the most likely balanced scorecard perspective it relates to. Label your answers using C...

-

Feller Company purchased a site for a limestone quarry for $100,000 on January 2, 2019. It estimate that the quarry will yield 400,000 tons of limestone. It estimates that its retirement obligation...

-

An underlying asset price is at 100, its annual volatility is 25% and the risk free interest rate is 5%. A European call option has a strike of 85 and a maturity of 40 days. Its BlackScholes price is...

-

Prescott Football Manufacturing had the following operating results for 2 0 1 9 : sales = $ 3 0 , 8 2 4 ; cost of goods sold = $ 2 1 , 9 7 4 ; depreciation expense = $ 3 , 6 0 3 ; interest expense =...

-

On January 1, 2018, Brooks Corporation exchanged $1,259,000 fair-value consideration for all of the outstanding voting stock of Chandler, Inc. At the acquisition date, Chandler had a book value equal...

Study smarter with the SolutionInn App