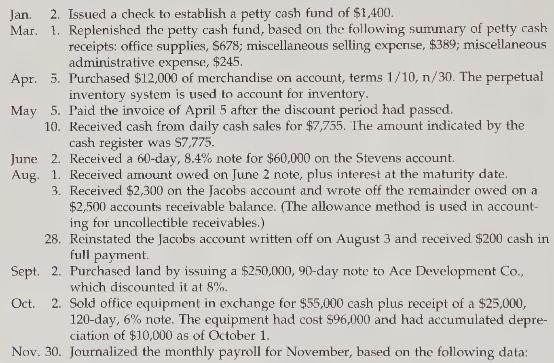

Selected transactions completed by Hirata Company during its first fiscal year ending December 31 were as follows:

Question:

Selected transactions completed by Hirata Company during its first fiscal year ending December 31 were as follows:

pension plan trustee.

{Instructions}

1. Journalize the selected transactions.

2. Based on the following data, prepare a bank reconciliation for December of the current year:

a. Balance according to the bank statement at December 31, \$123,200.

b. Balance according to the ledger at December \(31, \$ 108,680\).

c. Checks outstanding at December 31, \(\$ 27,450\).

d. Deposit in transit, not recorded by bank, \(\$ 12,450\).

e. Bank debit memorandum for service charges, \(\$ 280\).

f. A check for \(\$ 330\) in payment of an invoice was incorrectly recorded in the accounts as \(\$ 130\).

3. Based on the bank reconciliation prepared in (2), journalize the entry or entries to be made by Hirata Company.

4. Based on the following selected data, journalize the adjusting entries as of December 31 of the current year:

a. Estimated uncollectible accounts at December 31, \$6,490, based on an aging of accounts receivable. The balance of Allowance for Doubtful Accounts at December 31 was \(\$ 600\) (debit).

b. The physical inventory on December 31 indicated an inventory shrinkage of \(\$ 1,320\).

c. Prepaid insurance expired during the year, \(\$ 9,850\).

d. Office supplies used during the year, \(\$ 1,580\).

e. Depreciation is computed as follows:

f. A patent costing \(\$ 18,600\) when acquired on January 2 has a remaining legal life of nine years and is expected to have value for six years.

g. The cost of mineral rights was \(\$ 185,000\). Of the estimated deposit of 333,000 tons of ore, 22,500 tons were mined during the year.

h. Vacation pay expense for December, \(\$ 4,400\).

i. A product warranty was granted beginning December 1 and covering a one-year period. The estimated cost is \(2.5 \%\) of sales, which totaled \(\$ 796,000\) in December.

j. Interest was accrued on the note receivable received on October 2.

5. Based on the following information and the post-closing trial balance shown on the following page, prepare a balance sheet in report form at December 31 of the current year.

6. On February 7 of the following year, the merchandise inventory was destroyed by fire. Based on the following data obtained from the accounting records, estimate the cost of the merchandise destroyed:objs. \(2,3,4\)

Step by Step Answer:

Financial Accounting

ISBN: 9780324380675

10th Edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac