Sikes Corporation, whose fiscal year ends on December 31, issued the following bonds: Date of bonds: January

Question:

Sikes Corporation, whose fiscal year ends on December 31, issued the following bonds:

Date of bonds: January 1,2012 Maturity amount and date: \(\$ 10\) million due in 10 years (December 31,2021 )

Interest: 10 percent per annum payable each December 31 Date of sale: January 1,2012 Required:

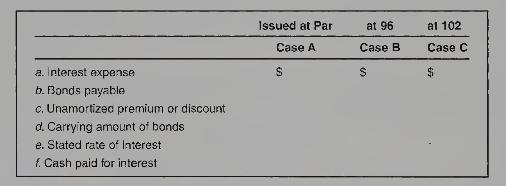

1. Provide the following amounts to be reported on the 2012 financial statements (use straight-line amortization and show amounts in thousands):

2. Explain why items \((a)\) and \((f)\) in (1) are different for cases B and C.

3. Assume that you are an investment adviser and a retired person has written to you asking, "Why should I buy a bond at a premium when I can find one at a discount? Isn't that stupid? It's like paying the list price for a car instead of negotiating a discount." Write a brief letter in response to the question.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby