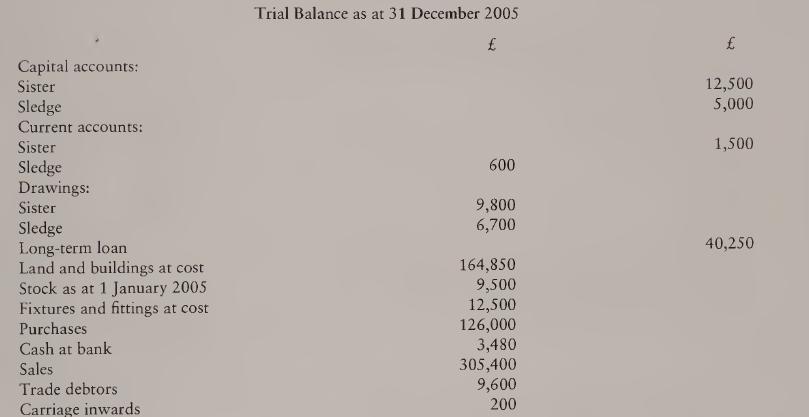

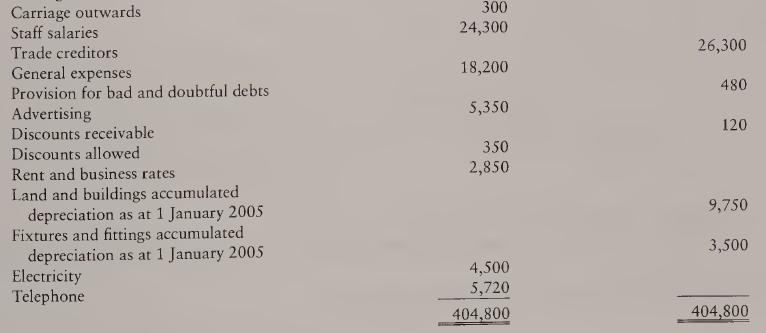

Sister and Sledge are trading in partnership, sharing profits and losses in the ratio of 2:1, respectively.

Question:

Sister and Sledge are trading in partnership, sharing profits and losses in the ratio of 2:1, respectively. The partners are entitled to salaries of Sister £6,000 per annum and Sledge £5,000 per annum. There is the following additional information.

(1) Stock as at 31 December 2005 was valued at £8,800.

(2) Staff salaries owing £290.

(3) Advertising paid in advance £200.

(4) Provision for bad and doubtful debts to be increased to £720.

(5) Provision should be made for depreciation of 2 % on land and buildings on cost, and for fixtures and fittings at 10 % on cost.

Required: Prepare the trading and profit and loss and appropriation account for the year ended 31 December 2005 and the balance sheet as at 31 December 2005.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: