Sophie's Catering Company is at its fiscal year-end, December 31, 2011. The following data were developed from

Question:

Sophie's Catering Company is at its fiscal year-end, December 31, 2011. The following data were developed from the company's records and related documents:

a. During 2011 , office supplies amounting to \(\$ 1,200\) were purchased for cash and debited to supplies inventory. At the beginning of 2011, the inventory of supplies on hand (unused) amounted to \(\$ 350\). The inventory of supplies on hand at December 31,2011 , was \(\$ 400\).

b. On December 31,2011 , the company catered an evening gala for a local celebrity. The \(\$ 7,500\) bill was payable by the end of January 2012. No cash has been collected, and no journal entry has been made for this transaction. (Ignore cost of goods sold.)

c. On December 15,2011 , repairs on one of the company's delivery vans were completed at a cost of \(\$ 600\); the amount is not yet recorded and will be paid at the beginning of January 2012.

d. On October 1, 2011, a one-year insurance premium on equipment in the amount of \(\$ 1,200\) was paid and debited to prepaid insurance. Coverage began on November 1.

e. In November 2011, Sophie's signed a lease for a new retail location, providing a down payment of \(\$ 2,100\) for the first three months. The amount was debited to prepaid rent. The lease began on December \(1,2011\).

f. On July 1, 2011, the company purchased new refrigerated display counters at a cash cost of \(\$ 18,000\). The estimated useful life of the equipment is five years, with an estimated residual value of \(\$ 3,000\). No depreciation has been recorded for 2011 (compute depreciation for six months in 2011).

g. On November 1,2011 , the company loaned \(\$ 6,000\) to one of its employees who signed a one-year, 10 percent note. The principal and interest are payable on October 31, 2012.

h. Profit before any of the adjustments or income taxes was \(\$ 22,400\). The company's income tax rate is 30 percent. Compute the adjusted profit, taking into consideration transactions

(a) through \((g)\) to determine the income tax expense for 2011.

Required:

1. Indicate whether each transaction relates to a deferred revenue, deferred expense, accrued revenue, or accrued expense.

2. Prepare the adjusting entry required for each transaction at December 31, 2011.

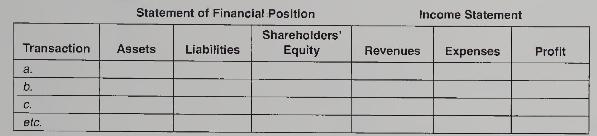

3. Using the following headings, indicate the effect of each adjusting entry and the amount of each. Use + for increase, - for decrease, and NE for no effect.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby