The comparative income statement for Chung Corporation for fiscal years 2010 and 2011 provided the following summarized

Question:

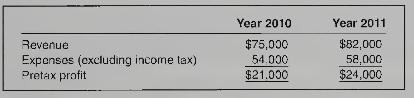

The comparative income statement for Chung Corporation for fiscal years 2010 and 2011 provided the following summarized pretax data:

The expenses for 2011 included an amount of \(\$ 3,000\) that was deductible only in the 2010 income tax return. The average income tax rate was 30 percent. Taxable income shown in the tax returns was \(\$ 18,000\) for 2010 and \(\$ 27,000\) for 2011 Required:

1. For each year, compute

(a) the income taxes payable and

(b) the deferred income tax. Is the deferred income tax a liability or an asset? Explain.

2. Prepare the journal entry for each year to record the income taxes payable, the deferred income tax, and the income tax expense.

3. Show the tax-related amounts that should be reported each year on the income statement and the statement of financial position. Assume that income tax is paid on March 1 of the next year.

4. Why would management want to incur the cost of preparing separate tax and financial accounting reports to defer the payment of taxes?

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby