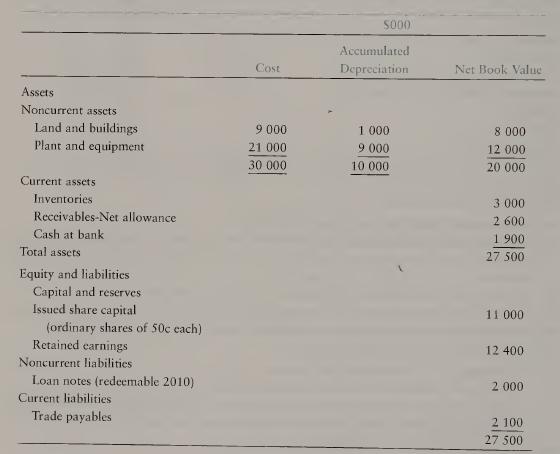

The draft statement of financial position shown below has been prepared for Shuswap, a limited liability company,

Question:

The draft statement of financial position shown below has been prepared for Shuswap, a limited liability company, as at 31 December 2009.

The following further information is available:

1. The land and buildings were revalued to $12 000 000 at 31 December 2009.

ii. Trade receivables totaling $200 000 are to be written off.

iii. During the year there was a contra settlement of $106 000 in which an amount due to a supplier was set off against the amount due from the same company for goods sold to it. No entry has yet been made to record the set-off.

iv. Some inventories items included in the draft statement of financial position at cost $500 000 were sold after the statement of financial position date for $400 000, with selling expense of $40 000.

V. The proceeds of issue of 4 000 000 50c shares at $1.10 per share, credited have not been recorded, vi. A plant was sold for $400 000 on 1 January 2009 with a net book value at the date of sale of $700 000, which had originally cost $1 400 000. No entries have been made for the disposal of the plant except for depreciation which has been charged at 25% (straight-line basis) in preparing the draft statement of financial position. The depreciation for the year relating to the plant sold should be adjusted in full.

Required: Prepare the company’s statement of financial position as at 31 December 2009. Details of noncurrent assets, adjusted appropriately, should appear as they are presented in the question. [ACCA adapted]

Step by Step Answer: