The following details relate to the trading activities of Anarkhi Ltd for its first year of trading,

Question:

The following details relate to the trading activities of Anarkhi Ltd for its first year of trading, to 30 June:

All purchases may be considered as part of cost of sales. All other costs should be allocated 40% to cost of sales, 40% to selling and distribution expenses, and 20% to administration expenses.

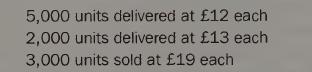

Anarkhi Ltd uses the FIFO method of stock valuation. On 23 June there was no trading stock. During the last week of the year, stock transactions were:

You are required to draft the trading and profit and loss and appropriation account for the year, adopting the Companies Act format as far as possible. You will need to calculate the value of the closing stock and to allocate the expenses as listed above to their Companies Act categories before you can construct the profit and loss account.

Step by Step Answer: