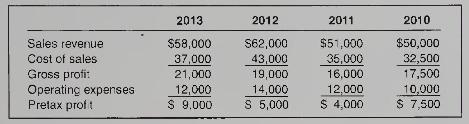

The income statements for four consecutive years for Clement Company reflected the following summarized amounts: Subsequent to

Question:

The income statements for four consecutive years for Clement Company reflected the following summarized amounts:

Subsequent to the development of these amounts, it has been determined that the physical inventory taken on December 31, 2011, was understated by \(\$ 3,000\).

Required:

1. Revise the income statements to reflect the correct amounts, taking into consideration the inventory error.

2. Compute the gross profit percentage for each year

(a) before the correction and

(b) after the correction. Do the results lend confidence to your corrected amounts? Explain.

3. What effect would the error have had on the income tax expense, assuming an average tax rate of 30 percent?

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby