The notes to a recent annual report from Weebok Corporation included the following: Business Acquisitions During the

Question:

The notes to a recent annual report from Weebok Corporation included the following:

Business Acquisitions During the current year, the company acquired the assets of Sport Shoes Inc.

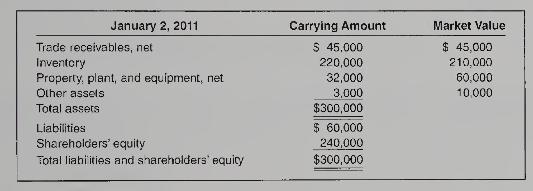

Assume that Weebok acquired Sport Shoes on January 2, 2011. Weebok acquired the name of the company and all of its assets, except cash, for \(\$ 450,000\) cash. Weebok did not assume the liabilities. On January 2, 2011, the statement of financial position of Sport Shoes reflected the following book values and an independent appraiser estimated the following market values for the assets:

Required:

1. Compute the amount of goodwill resulting from the purchase. (Hint: Assets are purchased at market value, which is their cost at the date of acquisition.)

2. Compute the adjustments that Weebok would make at the end of its fiscal year, December 31, 2011, for depreciation of all long-lived assets (straight line), assuming an estimated remaining useful life of 15 years and no residual value. The company does not amortize goodwill.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby