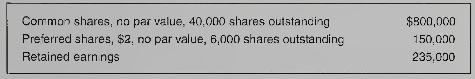

The records of Hoffman Company reflected the following balances in the shareholders' equity accounts at December 31,

Question:

The records of Hoffman Company reflected the following balances in the shareholders' equity accounts at December 31, 2011 :

On September 1, 2012, the board of directors was considering the distribution of a \(\$ 62,000\) cash dividend. No dividends were paid during 2010 and 2011 . You have been asked to determine dividend amounts under two independent assumptions (show computations):

a. The preferred shares are non-cumulative.

b. The preferred shares are cumulative.

\section*{Required:}

1. Determine the total amounts that would be paid to the preferred shareholders and to the common shareholders under the two independent assumptions.

2. Write a brief memo to explain why the dividend per common share was less under the second assumption.

3. Why would an investor buy Hoffman's common shares instead of its preferred shares if they pay a lower dividend per share? Explain. The market prices of the preferred and common shares were \(\$ 25\) and \(\$ 40\), respectively, on September \(1,2012\).

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby