UK Airways Ltd is nearing the end of its first year of operations. The company made stock

Question:

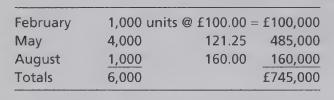

UK Airways Ltd is nearing the end of its first year of operations. The company made stock purchases of £745,000 during the year, as follows:

Sales for the year are 5,500 units for £1,500,000 of sales revenue. Expenses, other than cost of goods sold and income taxes, are £185,000. The directors of the company are undecided about whether to adopt the FIFO or the LIFO stock valuation method (assuming there is choice).

The company has storage capacity for 5,000 additional units of stock. Stock prices are expected to stay at £160.00 per unit for the next few months. The directors are considering purchasing 1,000 additional units of stock at £160.00 each before the end of the year. They wish to know how the purchase would affect net income under both FIFO and LIFO. The income tax rate is 31 percent.

Required

1 To aid company decision making, prepare income statements under FIFO and under LIFO, both without and with the year-end purchase of 1,000 units of stock at £160.00 per unit.

2 Compare net profits under FIFO without and with the year-end purchase. Make the same comparison under LIFO. Under which method does the year-end purchase have the greater effect on net profits?

3 Under which method can a year-end purchase be made in order to manage net profits?

Step by Step Answer:

Financial Accounting A Practical Introduction

ISBN: 9780273714293

1st Edition

Authors: Ilias Basioudis