USING FINANCIAL STATEMENTS AND TRANSACTION DATA TO PREPARE A STATEMENT OF CASH FLOWS. Erie Company has the

Question:

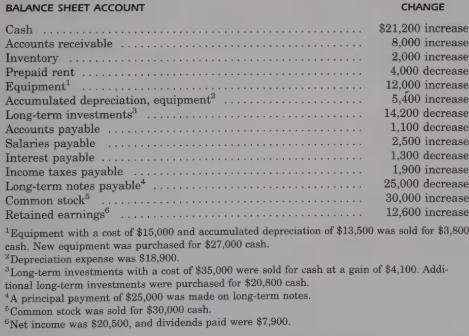

USING FINANCIAL STATEMENTS AND TRANSACTION DATA TO PREPARE A STATEMENT OF CASH FLOWS. Erie Company has the following data for 19x7:

REQUIRED:

Prepare a statement of cash flows for Erie, using the indirect method to compute cash flows from operations.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: