Wilson is preparing his bank reconciliation at 31 May 2011. His bank statement shows a balance of

Question:

Wilson is preparing his bank reconciliation at 31 May 2011. His bank statement shows a balance of $228 cash at the bank. The balance on the bank account in his general ledger is $113 (credit). He has noted the following reasons for the difference:

(i) Cheque number 958602 was incorrectly recorded in Wilson’s cashbook at $760. The cheque was correctly debited on the bank statement on 2 May as $670.

(ii) Bank charges of $428 were debited by the bank on 4 May.

(iii) A customer’s cheque for $320 was returned by Wilson’s bank in May as the customer had insufficient funds in his account. Wilson has not recorded the return of the cheque in his records.

(iv) The bank has incorrectly credited Wilson’s account with interest of $220. This is interest on a deposit account held by Wilson personally. The bank had not corrected the error by 31 May.

(v) A deposit of $850 entered in Wilson’s cashbook on 31 May was credited on the bank statement on 3 June.

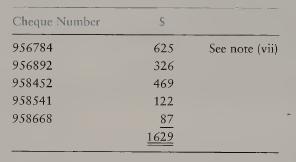

(vi) Five cheques have not yet been presented at the bank. These are:

(vii)Cheque number 956784 was lost in the post and was cancelled. Wilson has not recorded the cancellation of the cheque.

Required:

(a) Show Wilson’s general ledger bank account including the necessary correcting entries.

(b) Prepare a reconciliation of the bank statement balance to the corrected general ledger balance.

(c) Indicate how the bank balance will be reported in Wilson’s final accounts. [ACCA adapted]

Step by Step Answer: