You are preparing the year-end accounts for a client who buys and sells industrial machinery. You are

Question:

You are preparing the year-end accounts for a client who buys and sells industrial machinery. You are dealing with bad debts and closing inventories:

(a) Bad and doubtful debts Included in the trade receivables balance is an amount of $3574 that has been outstanding for just over a year. Your client has decided to write this balance off.

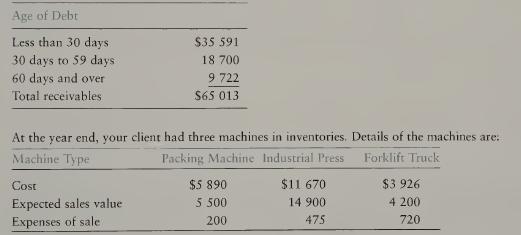

The allowance for doubtful debts is to be calculated as follows:

• 6% of balances that have been outstanding for between 30 and 59 days.

• 50% of balances that have been outstanding for 60 days or more.

At the end of the previous year the allowance for doubtful debts was $4516.

The trade receivables balances, including the irrecoverable balance of $3574, have been analysed as follows:

Required:

a. Briefly explain the difference between a bad debt and a doubtful debt.

b. Calculate the total charge to the statement of income for the year in respect of bad and doubtful debts and the value to be reported in the statement of financial position for trade receivables.

c. Briefly state the basic rule to be applied to the valuation of inventories.

d. Calculate the value of closing inventories to be reported in the statement of financial position. [ACCA adapted]

Step by Step Answer: