The Chungs are married with one dependent child. They report the following information for 2022: Compute AGI,

Question:

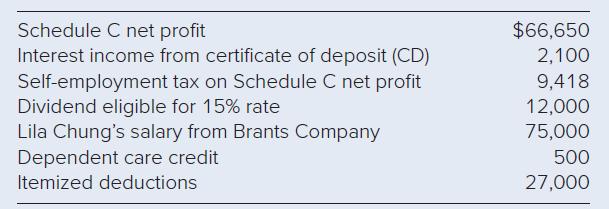

The Chungs are married with one dependent child. They report the following information for 2022:

Compute AGI, taxable income, and total tax liability (including self employment tax). Assume that Schedule C net profit is qualified business income (non-service income) under Section 199A.

Transcribed Image Text:

Schedule C net profit Interest income from certificate of deposit (CD) Self-employment tax on Schedule C net profit Dividend eligible for 15% rate Lila Chung's salary from Brants Company Dependent care credit Itemized deductions $66,650 2,100 9,418 12,000 75,000 500 27,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 44% (9 reviews)

Wages Schedule C Net Profit Interest from CD Dividend Income Abovetheline deduction for o...View the full answer

Answered By

Saurabh Shukla

Currently pursuing my final year graduation degree with geology and maths as a major subject from a renowned university in India. I believe love for the subject can take you to the infinity.

If you love the subject, you gonna feel the essence of that subjects and it will never be boring and they way you can connect with any subject is to get involved in that subject completely. The more you give time to something the more you get addicted to it, same applies to your studies and for me definition of favorite subject is -- That subject that keeps you going and even after studying for long , at the end you feel like you learnt alot and want to read that subject as much as you can and get deeper insights about the subject.

I have tutored and solved doubts of students from various fields be it from engineering, maths, earth science, physics and what not.

I believe in delivering best performance and putting my 100% Irrespective of what I'm doing.

I've tutoring experience of more than 2 years and helped thousands of students across the country.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Taxation For Business And Investment Planning 2023

ISBN: 9781264229741

26th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick

Question Posted:

Students also viewed these Business questions

-

Mr. and Mrs. Wilson are married with one dependent child. They report the following information for 2020: Schedule C net profit $66,650 Interest income from certificate of deposit (CD) 2,100...

-

Mr. and Mrs. Wilson are married with one dependent child. They report the following information for 2018. Schedule C net profit .............................................................. $66,650...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Reference frame S is moving along the x axis at 0.6c relative to frame S. A particle that is originally at x = 10 m at t 1 = 0 is suddenly accelerated and then moves at a constant speed of c/3 in...

-

Trafflet Enterprises incorporated on May 3, 2011. The company engaged in the following transactions during its first month of operations: May 3 Issued capital stock in exchange for $800,000 cash. May...

-

Determine the value(s) of h such that the matrix is the augmented matrix of a consistent linear system. 1 -2 h 4 -3 6

-

I know how much I owe on my credit cards each month before I receive my bills. (A) Yes (B) Sometimes (C) No

-

Future Value and Multiple Cash Flows Paradise, Inc., has identified an investment project with the following cash flows. If the discount rate is 8 percent, what is the future value of these cash...

-

Suppose Intel stock has a beta of 1.7, whereas Boeing stock has a beta of 0.91. If the risk-free interest rate is 5.9% and the expected return of the market portfolio is 12.5%, according to the CAPM,...

-

Ms. Singh, who is in the 37 percent tax bracket, owns a residential apartment building that generates $80,000 annual taxable income. She plans to create a family partnership by giving each of her two...

-

Mr. and Mrs. Tinker own a sizable investment portfolio of stock in publicly held corporations. The couple has four childrenages 20, 22, 25, and 27with whom they want to share their wealth....

-

Determine a value index for 2018 using 2010 as the base period. Price Quantity Item 2010 2018 2010 2018 Aluminum (cents per pound) Natural gas $ per million BLA Petroleum (barrel) Platinum (troy...

-

Explain in details the reasons for your classifications. Classify the following processes as batch, continuous, or semibatch, and transient or steady- state. 1. A balloon is filled with air at a...

-

Question 5. A first responder drone of mass m slug is launched with a velocity vo ft/sec and constant engine force F from a level ground and moves vertically upward to discover a sense of life in a...

-

As part of the investigation of the collapse of the roof of a building. a testing laboratory is given all the available bolts that connected the steel structure at 3 different positions on the roof....

-

1) Baris Diary Co. has three product and divisions for production process of Milk, Yogurt and Cheese. Company's data show following resulst for 2014: Milk Yogurt Revenue 100.000TL 125.000TL Cheese...

-

Problem 11-4B (Algo) Prepare a statement of cash flows-indirect method (LO11-2, 11-3, 11-4, 11-5) The income statement, balance sheets, and additional information for Virtual Gaming Systems are...

-

1. Define indigenous religion, and describe at least one aspect of indigenous religions that exists in a similar form in a traditional mainstream religion. Define religion, and discuss why it is...

-

Does log 81 (2401) = log 3 (7)? Verify the claim algebraically.

-

Rochelle is a limited partner in Megawatt Partnership. For 2023, her Schedule K-1 from the partnership reported the following share of partnership items: a. Calculate the net impact of the given...

-

For 2023, Ms. Deming earned wages totaling $225,000. Calculate any .9 percent additional Medicare tax owed, assuming that. a. Ms. Deming is single. b. Ms. Deming files a joint return with her husband...

-

In 2023, Wilma Ways sole proprietorship, WW Bookstore, generated $120,000 net profit. In addition, Wilma recognized a $17,000 Section 1231 gain on the sale of business furniture. The business...

-

( US$ millions ) 1 2 / 3 1 / 2 0 1 4 1 2 / 3 1 / 2 0 1 3 1 2 / 3 1 / 2 0 1 2 1 2 / 3 1 / 2 0 1 1 Net income $ 1 4 , 4 3 1 $ 1 2 , 8 5 5 $ 1 0 , 7 7 3 $ 9 , 7 7 2 Depreciation 3 , 5 4 4 2 , 7 0 9 1 ,...

-

net present value of zero

-

Suppose at Time 0 a dealer buys $100 par of a 4%-coupon 30-year bond for a price of par and posts the bond as collateral in a repo with zero haircut. The repo rate is 5%. Then, 183 days later, the...

Study smarter with the SolutionInn App