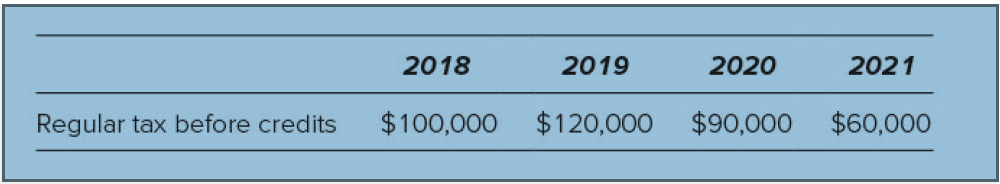

Callen Inc. has accumulated minimum tax credits of $1.3 million from tax years prior to 2018. The

Question:

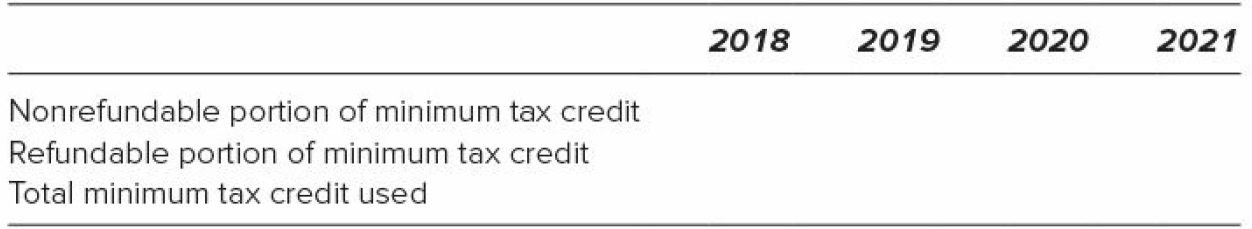

Complete the following table to calculate Callen€™s allowable minimum tax credit each year.

Transcribed Image Text:

2018 2020 2021 2019 Regular tax before credits $100,000 $120,000 $90,000 $60,000 2018 2019 2020 2021 Nonrefundable portion of minimum tax credit Refundable portion of minimum tax credit Total minimum tax credit used

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

2018 2019 2020 2021 Nonrefundable portion of minimum t...View the full answer

Answered By

Carly Cimino

As a tutor, my focus is to help communicate and break down difficult concepts in a way that allows students greater accessibility and comprehension to their course material. I love helping others develop a sense of personal confidence and curiosity, and I'm looking forward to the chance to interact and work with you professionally and better your academic grades.

4.30+

12+ Reviews

21+ Question Solved

Related Book For

Principles Of Taxation For Business And Investment Planning 2019 Edition

ISBN: 9781260161472

22nd Edition

Authors: Sally Jones, Shelley C. Rhoades Catanach, Sandra R Callaghan

Question Posted:

Students also viewed these Business questions

-

Jackson Corporation has accumulated minimum tax credits of $475,000 from tax years prior to 2018. If 2018 regular tax before credits is $210,000 and Jackson qualifies for general business credits of...

-

Talon Corporation has accumulated minimum tax credits from prior years. However, it currently projects that it will operate at a loss for 2018 and 2019, owing no regular tax liability for these...

-

During the current year, Joule Company, a sole proprietorship, earned general business tax credits of $30,000 for energy conservation and rehabilitation expenditures. The owner, Mark Joule, knows...

-

A database is to be made to store information about a catalogue of CDs. Information to be stored about each CD includes title, price, genre, and a list of tracks. Each CD will also have an artist,...

-

After Rollins made the decision to hire Eugene Smith, what measures could Rollins, White Eagle, and Martin have taken to enhance Smith's chances of being successful with the given firm?

-

In each of the situations below, state whether the financial asset and financial liability must be offset in the books of Company A as at 30 June 2012, and explain why. (a) Company A owes company B...

-

For your answer to Question 3, to which categories does hedge accounting apply?

-

Phoenix Company's 2017 master budget included the following fixed budget report. It is based on an expected production and sales volume of 15,000 units. Required 1. Classify all items listed in the...

-

The checklist of steps necessary for approving an invoice for recording and payment, als the O Purchase requisition. O Purchase order. O Invoice. O Receiving report. Invoice approval. Hisense

-

The results of a search to find the least expensive round-trip flights to Atlanta and Salt Lake City from 14 major U.S. cities are shown in the following table. The departure date was June 20, 2012,...

-

Camden Corporation, a calendar year accrual basis corporation, reported $5 million of net income after tax on its current year financial statements prepared in accordance with GAAP. In addition, the...

-

Hall Corporation plans to invest $5.5 million in rehabilitating a certified historic structure. Calculate the net present value of Halls allowable rehabilitation credit. Assume Hall has ample taxable...

-

What are the four major components of stockholders' equity? Explain each component.

-

Drs. Draper and Keys run a partnership family medical practice in Brownsville, Texas. While the practice is profitable, both physicians are making payments on heavy debt loads for student loans that...

-

Sweetlip Ltd and Warehou Ltd are two family-owned flax-producing companies in New Zealand. Sweetlip Ltd is owned by the Wood family and the Bradbury family owns Warehou Ltd. The Wood family has only...

-

Small Sample Weights of M&M plain candies are normally distributed. Twelve M&M plain candies are randomly selected and weighed, and then the mean of this sample is calculated. Is it correct to...

-

Swain Athletic Gear (SAG) operates six retail outlets in a large Midwest city. One is in the center of the city on Cornwall Street and the others are scattered around the perimeter of the city....

-

The Tokyo Olympics After watching How the Tokyo Olympics Became the Most Expensive Summer Game Ever video answer the following questions. * * The numbers can be made up . I just need help with an...

-

The following frequency distribution represents the sprint speed (in feet per second) of all players in Major League Baseball during the 2018 baseball season. In Problems find (a) The number of...

-

Find the reduced echelon form of each of the matrices given in Problems 120. c 1 26 + 4

-

Mr. Tillotson has not paid income tax or filed a tax return for the last eight years. He believes that the IRS can no longer assess back taxes for the first five of those years. Identify the tax...

-

Nunoz Inc., a calendar year taxpayer, incurred a net operating loss in 2018 that it carried back as a deduction against 2016 income. Nunozs treasurer filed a claim for a $712,600 refund of 2016 tax...

-

On July 2, Mrs. Nation received a notice assessing a $10,861 tax deficiency. She was short of funds, so she did not pay her tax bill within 10 days as required by the notice. Instead, she waited...

-

please explain thoroughly how to do in excel 1. Find the number of units to ship from each factory to each customer that minimizes total cost

-

For esch of the following Independent tranactiona, determine the minimum amount of net income or loas for tox purposes snd the tsxpsyer to which it applies. 1 An individual purchases a $ 1 0 , 0 0 0...

-

Suppose a bond has a modified duration of 4. By approximately how much will the bonds value change if interest rates: a. Increase by 50 basis points b. Decrease by 150 basis points c. Increase by 10...

Study smarter with the SolutionInn App