Corporations are required to detail their book/tax differences on either Schedule M-1 or Schedule M-3 attached to

Question:

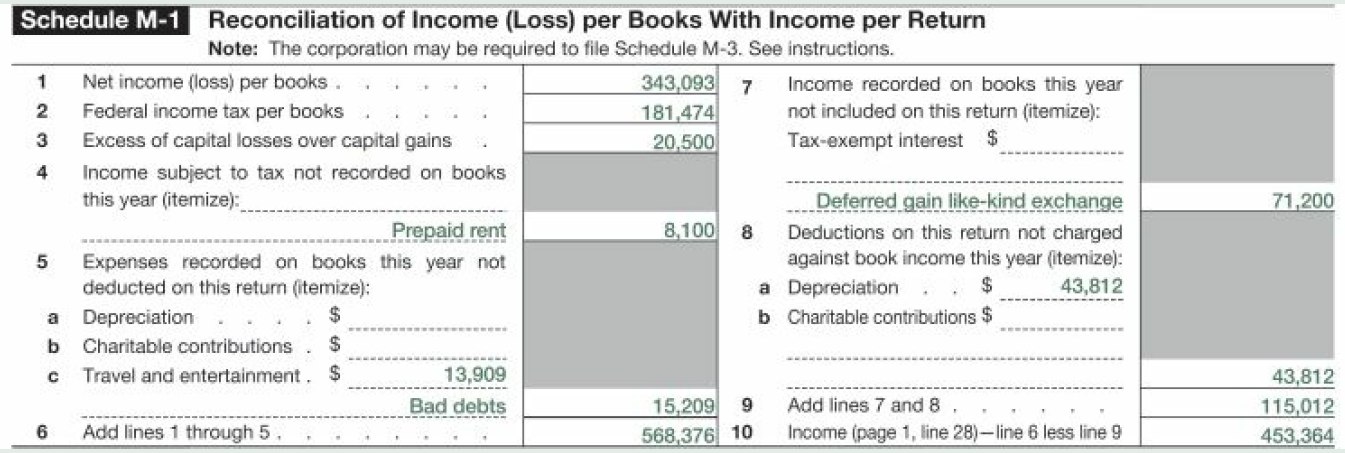

Schedule M-1

Transcribed Image Text:

Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Note: The corporation may be required to file Schedule M-3. See instructions. Net income (loss) per books . Federal income tax per books Excess of capital losses over capital gains 343,093 7 181,474 Income recorded on books this year not included on this return (itemize): Tax-exempt interest 2. 20,500 Income subject to tax not recorded on books this year (itemize): Deferred gain like-kind exchange Deductions on this return not charged against book income this year (itemize): 71,200 8,100 Prepaid rent Expenses recorded on books this year not deducted on this return (itemize): Depreciation Charitable contributions . Travel and entertainment. $ 2$ 43,812 a Depreciation b Charitable contributions $ 2$ a 13,909 43,812 115,012 453,364 Add lines 7 and 8 Income (page 1, line 28)-line 6 less line 9 15,209 Bad debts Add lines 1 through 5. 568,376 10

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (10 reviews)

For many corporations book income has been reviewed or audi...View the full answer

Answered By

Lawrence Okyere

My professional qualities are a strong communicator, a good listener, a good collaborator, I'm adaptable, I'm engaging, and I've patient and empathy.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Taxation For Business And Investment Planning 2019 Edition

ISBN: 9781260161472

22nd Edition

Authors: Sally Jones, Shelley C. Rhoades Catanach, Sandra R Callaghan

Question Posted:

Students also viewed these Business questions

-

You have recently been hired by Goff Computer, Inc. (GCI), in the finance area. GCI was founded eight years ago by Chris Goff and currently operates 74 stores in the Southeast. GCI is privately owned...

-

Publicly traded corporations are required to have their financial statements audited by an independent auditor. The Canadian Securities Administrators National Instrument 52-109 Certification of...

-

You have recently been hired by Layton Motors, Inc. (LMI), in its relatively new treasury management department. LMI was founded eight years ago by Rachel Layton. Rachel found a method to manufacture...

-

Calculate the dollar proceeds from the FIs loan portfolio at the end of the year, the return on the FIs loan portfolio, and the net interest margin for the FI if the spot foreign exchange rate has...

-

KPMG Azsa ultimately agreed to accept Olympus's accounting decisions for the Gyrus acquisition after being given an "experts" report that supported those decisions. In the United States, what...

-

Consider a single sampling plan with a lot size of 1500, sample size of 150, and acceptance number of 3. Construct the OC curve. If the acceptable quality level is 0.05% nonconforming and the...

-

What conditions must be met to qualify a forward exchange contract as the hedge of a firm foreign-currency-denominated commitment!

-

Journal entries related to the income statement. Toyota Motor Company (Toyota), the Japanese car manufacturer, reported Sales of Products of 22,670 billion for the year ended March 31, 2007. The Cost...

-

no info missing. just have to know if you have to deduct add orit has jo effect in the income tax the company 2021 year ended taxation year ending december 31,2021. using ASPE the accountant has...

-

Both Mr. Byrd and Mrs. Byrd are employed. During 2019, Mr. Byrd had opened a restaurant and had business income of $12000. Mr. Byrd also had net employment income of $52000, after deducting $10100 of...

-

Corporations are allowed a dividends-received deduction for dividends from other domestic, taxable corporations. How does this deduction prevent the same corporate income from potentially three...

-

In your own words, explain why a tax credit is more valuable than a tax deduction of the same dollar amount.

-

At a given instant the wheel is rotating with the angular velocity and angular acceleration shown. Determine the acceleration of block B at this instant. Given: @ = 2 a = 6 rad S rad 2 S 1 = 1.5 m 8...

-

Absorption linewidth for an absorbing atomic transition. Consider the curves of power transmission T(w) = exp[-2am(w)L] through an atomic medium with a lorentzian resonant transition, plotted versus...

-

EXAMPLE 05.04 Z Write the force and the couple in the vector form (with rectangular/Cartesian components). Use C = 180 N-m and P = 500 N O INDIVIDUAL Submission (IS12) D x 400 mm B C 300 mm A 400 mm...

-

1.XYZ Corporation budgets factory overhead cost of P500,000 for the coming year. Compute for the overhead cost applied to the job. The following data are available: Budgeted annual overhead for...

-

OP Technologies Manufacturing manufactures small parts and uses an activity-based costing system. Activity Materials Assembling Packaging Est. Indirect Activity Costs $65,000 $242,000 $90,000...

-

3. Solve Example 3.7 (Bergman, Lavine, Incropera, and DeWitt, 6th Ed., pp. 129-132, or 7th Ed., pp. 145-149, or 8th Ed., pp. 134-138), but use the finite difference method. T T = 30C Insulation-...

-

Suppose that in the absence of any corrective measures, the economy generates 750 megatonnes (Mt) of GHG emissions (E) per year. The damage created by an additional Mt of emissions is called the...

-

Subtract the polynomials. (-x+x-5) - (x-x + 5)

-

Mr. and Mrs. Ahern pay $18,000 annual tuition to a private school for their three children. They also pay $2,300 property tax on their personal residence to support the local public school system....

-

This year, Lexon Company built a light industrial facility in County G. The assessed property tax value of the facility is $20 million. To convince Lexon to locate within its jurisdiction, the county...

-

Churchill University is located in a small town that depends on real property taxes for revenue. Over the past decade, the university has expanded by purchasing a number of pcommercial buildings and...

-

Suppose you bought a bon with an annual coupon rate of 6.5 percent one year ago for $1,032. The bond sells for $1,020 today. a. Assuming a $1,000 face value, what was your total dollar return on this...

-

During the year 2021, William has a job as an accountant, he earns a salary of $100,000. He has done some cleaning services work on his own (self-employed), where he earned a net income of $50,000....

-

Fixed cost per unit is $7 when 25,000 units are produced and $5 when 35,000 units are produced. What is the total fixed cost when 30,000 units are produced? Group of answer choices $150,000....

Study smarter with the SolutionInn App