TRW Inc. began business in 2018 and incurred net operating losses for its first two years. In

Question:

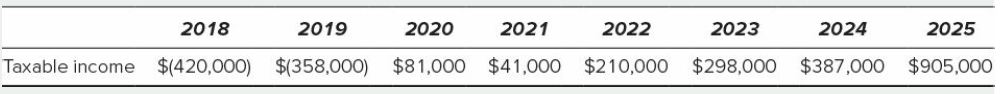

Recompute TRW€™s taxable income for 2020 through 2025 after its allowable net operating loss deduction.

Transcribed Image Text:

2021 2022 2025 2018 2019 2020 2023 2024 Taxable income $(420,000) $(358,000) $81,000 $41,000 $210,000 $298,000 $387,000 $905,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (10 reviews)

TRWs taxable income for 2020 through 2025 is computed as follows TRWs NOL ded...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

Principles Of Taxation For Business And Investment Planning 2019 Edition

ISBN: 9781260161472

22nd Edition

Authors: Sally Jones, Shelley C. Rhoades Catanach, Sandra R Callaghan

Question Posted:

Students also viewed these Business questions

-

Corporation WJ began business in 2018 and elected S corporation status. This year, it operated at a significant loss, flowing through $(624,000) of ordinary business loss to its sole shareholder,...

-

Charter Corporation, which began business in 2018, appropriately uses the installment sales method of accounting for its installment sales. The following data were obtained for sales made during 2018...

-

Charter Corporation, which began business in 2018, appropriately uses the installment sales method of accounting for its installment sales. The following data were obtained for sales during 2018 and...

-

When VGS = 0.5 VGS(off) . gm. is -------------- the maximum value. Select one: a. one-fourth b. three-fourths c. equal to d. one-half

-

The length and width of a rectangular room are measured to be 3.955 0.005m and 3.050 0.005m. Calculate the area of the room and its uncertainty in square meters Units Date Date Date Unit Cost Unit...

-

Name all the different sources for reading the Internal Revenue Code. What are the major advantages and challenges for each different type of source?

-

Improving driving performance while fatigued. Refer to the Human Factors (May, 2014) study of driving performance while fatigued, Exercise 9.31 (p. 549). Recall that the researchers had 40 college...

-

Matulis, Inc., a C corporation, owns a single asset with a basis of $325,000 and a fair market value of $800,000. Matulis holds a positive E & P balance. It elects S corporation status and then sells...

-

Audio City, Inc., is developing its annual financial statements at December 31. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income...

-

Routing Paths and Subnets LATEST SUBMISSION GRADE 0% 1. Let's see how much you've learned about routing paths and subnetting! In this activity, you are given a bunch of source and destination IP...

-

For its first taxable year, Rony Inc.'s accounting records showed the following. Operating loss per books $(800,000) Temporary book/tax difference 90,000 Net operating loss for tax $(710,000) a. Use...

-

Extronic, a calendar year, accrual basis corporation, reported a $41,900 liability for accrued 2017 state income tax on its December 31, 2017, balance sheet. Extronic made the following state income...

-

Buffalo, Inc., uses composite depreciation for its assets. Buffalo, Inc., owns a car with a cost of $25,000, a residual value of $1,500, and a useful life of 5 years; as well as equipment with a cost...

-

Sams old friend Dot is considering setting up a business offering historical boating trips along the River Thames. Dot thinks that she may be able to make a good living out of this. She has carried...

-

Arrow Industries employs a standard cost system in which direct materials inventory is carried at standard cost. Arrow has established the following standards for the direct costs of one unit of...

-

Explain the financial effect (increase, decrease, or no effect) of each of the following transactions on stockholders' equity: a. Purchased supplies for cash. b. Paid an account payable. c. Paid...

-

What type of account-asset, liability, stockholders' equity, dividend, revenue, or expense-is each of the following accounts? Indicate whether a debit entry or a credit entry increases the balance of...

-

Is it possible for an accounting transaction to only affect the left side of the accounting equation and still leave the equation in balance? If so, provide an example.

-

In Problems find the value of each factorial. 5!

-

Will the prediction interval always be wider than the estimation interval for the same value of the independent variable? Briefly explain.

-

Mr. and Mrs. JC were married in 1997. This year they traveled to Reno, Nevada, immediately after Christmas and obtained a divorce on December 29. They spent two weeks vacationing in California,...

-

Mr. and Mrs. CD engage a CPA to prepare their Form 1040. For the last two years, their itemized deductions totaled $11,014 and $12,300. The CPA estimates that $750 of his fee relates to the...

-

Mr. and Mrs. TB have an 11-year-old child. The couple is divorced, and Mrs. TB has sole custody of the child. However, Mr. TB pays his former wife $1,200 child support each month. Identify the tax...

-

Compute the value of ordinary bonds under the following circumstances assuming that the coupon rate is 0.06:(either the correct formula(s) or the correct key strokes must be shown here to receive...

-

A tax-exempt municipal bond has a yield to maturity of 3.92%. An investor, who has a marginal tax rate of 40.00%, would prefer and an otherwise identical taxable corporate bond if it had a yield to...

-

Please note, kindly no handwriting. Q. Suppose a 3 year bond with a 6% coupon rate that was purchased for $760 and had a promised yield of 8%. Suppose that interest rates increased and the price of...

Study smarter with the SolutionInn App