Mr.M. runs a business. Each year, with a probability of 0.1, Mr.M. quits this business. Given that

Question:

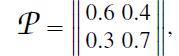

Mr.M. runs a business. Each year, with a probability of 0.1, Mr.M. quits this business. Given that this does not happen, Mr. M. faces either “bad” or “good” year with respective average incomes 1 or 2. The transition probabilities for these two states are specified by the matrix

where zero state corresponds to a “bad” year. The initial year is “good.” Evaluate the expected discounted total income in the long run for v = 0.9.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: