An analyst gathers exchange rate data for five currencies relative to the US dollar. Upon inspection of

Question:

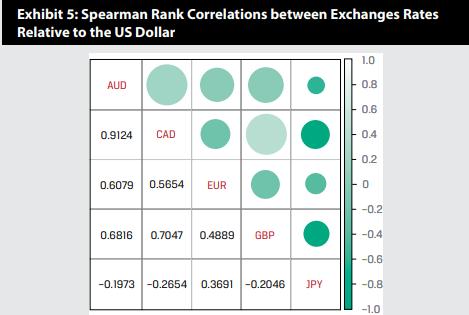

An analyst gathers exchange rate data for five currencies relative to the US dollar. Upon inspection of the distribution of these exchange rates, she observes a departure from normality, especially with negative skewness for four of the series and positive skewness for the fifth. Therefore, she decides to examine the relationships among these currencies using Spearman rank correlations. She calculates these correlations between the currencies over 180 days, which are shown in the correlogram in Exhibit 5. In this correlogram, the lower triangle reports the pairwise correlations and the upper triangle provides a visualization of the magnitude of the correlations, with larger circles indicating the larger absolute value of the correlations and darker circles indicating correlations that are negative.

For any of these pairwise Spearman rank correlations, can we reject the null hypothesis of no correlation (H0: rS = 0 and Ha: rS ≠ 0) at the 5 percent level of significance?

Step by Step Answer: