Anna Cintara is constructing different portfolios from the following two stocks: 1. Calculate the covariance between the

Question:

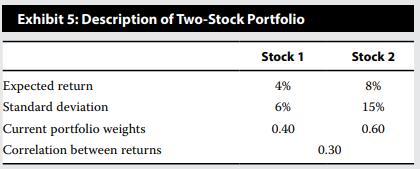

Anna Cintara is constructing different portfolios from the following two stocks:

1. Calculate the covariance between the returns on the two stocks.

2. What is the portfolio expected return and standard deviation if Cintara puts 100 percent of her investment in Stock 1 (w1 = 1.00 and w2 = 0.00)? What is the portfolio expected return and standard deviation if Cintara puts 100 percent of her investment in Stock 2 (w1 = 0.00 and w2 = 1.00)?

3. What are the portfolio expected return and standard deviation using the current portfolio weights?

4. Calculate the expected return and standard deviation of the portfolios when w1 goes from 0.00 to 1.00 in 0.10 increments (and w2 = 1 – w1). Place the results (stock weights, portfolio expected return, and portfolio standard deviation) in a table, and then sketch a graph of the results with the standard deviation on the horizontal axis and expected return on the vertical axis.

Step by Step Answer: