Based on Exhibit 1, Olabudo should calculate a prediction interval for the actual US CPI closest to:

Question:

Based on Exhibit 1, Olabudo should calculate a prediction interval for the actual US CPI closest to:

A. 2.7506 to 2.7544.

B. 2.7521 to 2.7529.

C. 2.7981 to 2.8019.

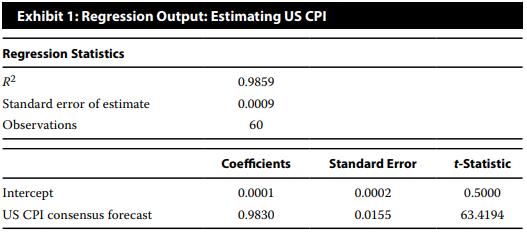

Doug Abitbol is a portfolio manager for Polyi Investments, a hedge fund that trades in the United States. Abitbol manages the hedge fund with the help of Robert Olabudo, a junior portfolio manager. Abitbol looks at economists’ inflation forecasts and would like to examine the relationship between the US Consumer Price Index (US CPI) consensus forecast and the actual US CPI using regression analysis. Olabudo estimates regression coefficients to test whether the consensus forecast is unbiased. If the consensus forecasts are unbiased, the intercept should be 0.0 and the slope will be equal to 1.0. Regression results are presented in Exhibit 1. Additionally, Olabudo calculates the 95 percent prediction interval of the actual CPI using a US CPI consensus forecast of 2.8.

1. The absolute value of the critical value for the t-statistic is 2.002 at the 5 percent level of significance.

2. The standard deviation of the US CPI consensus forecast is sx = 0.7539.

3. The mean of the US CPI consensus forecast is _ X = 1.3350.

Finally, Abitbol and Olabudo discuss the forecast and forecast interval:

■ Observation 1. For a given confidence level, the forecast interval is the same no matter the US CPI consensus forecast.

■ Observation 2. A larger standard error of the estimate will result in a wider confidence interval.

Step by Step Answer: