Suppose a 10 percent tax is imposed on airplane tickets. a. Use Equation (15.3) to calculate the

Question:

Suppose a 10 percent tax is imposed on airplane tickets.

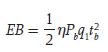

a. Use Equation (15.3) to calculate the excess burden of this tax when the price elasticity of compensated demand is -1.1 and airplane ticket revenues are $91 billion annually.

b. In the short run, the supply of flights is relatively inelastic, since flights have been scheduled and customers have purchased their tickets, while supply is very elastic in the long run, because airlines are free to cancel flights and adjust their routes. Use the expression for excess burden in footnote 7 to contrast the excess burden from the airplane ticket tax from a short-run perspective with the excess burden in the long run.

c. Air travel contributes to greenhouse gas emissions. Discuss how this consideration may alter the size of the excess burden from the tax on airplane tickets.

Step by Step Answer:

Public Finance In Canada

ISBN: 9781259030772

5th Canadian Edition

Authors: Harvey S. Rosen, Ted Gayer, Jean-Francois Wen, Tracy Snoddon