The applied incidence study by Lee (2007), discussed in this chapter, assumes that personal income taxes are

Question:

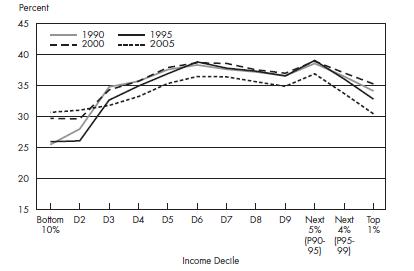

The applied incidence study by Lee (2007), discussed in this chapter, assumes that personal income taxes are fully borne by the taxpayer with no shifting. However, there is some evidence provided by Schaafsma (1992) that Canadian dentists shift a portion of personal income taxes onto dental patients in the form of higher dental fees. Suppose that all highend professional labour (e.g., lawyers, doctors) is able to fully shift forward personal income taxes onto consumers. Discuss how this might affect the pattern of tax incidence represented in Figure 14.12.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Public Finance In Canada

ISBN: 9781259030772

5th Canadian Edition

Authors: Harvey S. Rosen, Ted Gayer, Jean-Francois Wen, Tracy Snoddon

Question Posted: