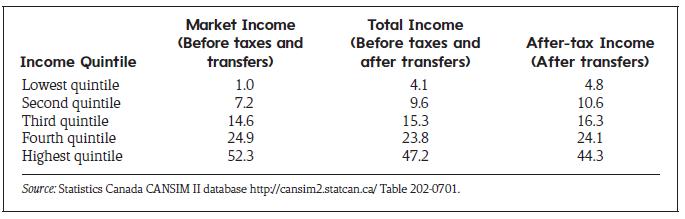

The table below shows the income shares by quintile for Canada in 2011 for different income measures.

Question:

The table below shows the income shares by quintile for Canada in 2011 for different income measures.

a. Calculate the cumulative income shares for all three income measures.

b. Draw the Lorenz curve for each income concept using an Excel spreadsheet or by sketching a graph. According to the data, what contributes more to reducing income inequality in Canada—transfers or taxes? Discuss.

c. Suppose instead of calculating income shares and drawing the Lorenz curves, as above, you use the Gini coefficient to determine the effect of government taxes and transfers on income inequality (for 2011, the Gini coefficient was 0.514 based on market income and 0.395 based on income after taxes and transfers). Briefly discuss the advantages (or disadvantages) of using this approach rather than the Lorenz curve approach to measuring the effect of government policies on income inequality.

Step by Step Answer:

Public Finance In Canada

ISBN: 9781259030772

5th Canadian Edition

Authors: Harvey S. Rosen, Ted Gayer, Jean-Francois Wen, Tracy Snoddon