Integrated Physicians & Associates, an investor-owned company, had the following general ledger account balances at the end

Question:

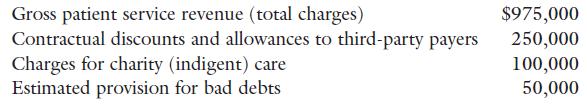

Integrated Physicians & Associates, an investor-owned company, had the following general ledger account balances at the end of 2015:

a. Construct the revenue section of Integrated Physicians & Associates’ income statement for the year ended December 31, 2015.

b. Suppose the 2015 contractual discounts and allowances balance reported above is understated by $50,000. In other words, the correct balance should be $300,000. Assuming a 40 percent income tax rate, what would be the effect of the misstatement on Integrated Physicians & Associates’ 2015 reported:

1. Net patient service revenue?

2. Total expenses, including income tax expense?

3. Net income?

For each item (1–3), indicate whether the balance is overstated, understated, or not affected by the misstatement. If overstated or understated, indicate by how much.

Step by Step Answer:

Healthcare Finance: An Introduction To Accounting And Financial Management

ISBN: 9781567937411

6th Edition

Authors: Louis Gapenski