Question

1. Joint products A and B emerge from common processing that costs $200,000 and yields 2,000 units of Product A and 1,000 units of Product

1. Joint products A and B emerge from common processing that costs $200,000 and yields 2,000 units of Product A and 1,000 units of Product B.

? Product A can be sold for $100 per unit.

? Product B can be sold for $120 per unit.

How much of the joint cost will be assigned to Product A if joint costs are allocated on the basis of relative sales values? Choose the closest answer to your computation.

a. $75,000

b. $133,333

c. $125,000

d. $100,000

e. $90,090

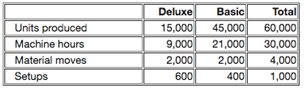

2. Curly Manufacturing is estimating overhead of $600,000 for next year that is allocable to its deluxe and basic product lines. At the beginning of the year, they predicted the following activity levels of various potential cost drivers:

a. How much overhead cost is expected to be allocated to the deluxe product line if machine hours are the chosen cost driver?

b. How much overhead cost is expected to be allocated to the basic product line if setups are the chosen cost driver?

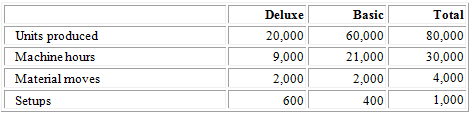

3. Moe Manufacturing uses an activity-based cost system to assign overhead costs. At the beginning of the year, they predicted the following activity levels of various potential cost drivers:

The following overhead costs are projected:

Material handling costs (use number of moves).... $ 80,000

Setups (use number of setups) ..............................$ 60,000

Machine-related costs (use machine hours)?.......$300,000

Total projected overhead: ....................................$440,000

A. What is the activity rate for the material moves pool?

B. How much of the $440,000 overhead cost will be allocated to a job of 180 units that requires 2 setups, 50 machine hours and 10 material moves?

4. Sera Manufacturing uses an activity-based cost system.

The following ABC rates have already been calculated.

Overhead pools Activity rate

Pool A..........................$7 per direct labor hour

Pool B........................................$500 per setup

Pool C..............................$4 per machine hour

Job 657H has the following inputs.

? 40 direct labor hours (the direct labor rate is $20 per hour)

? 30 pounds of materials (the material cost is $5 per pound)

? 2 setups

? 12 machine hours

A. Enter the total amount of overhead applied to this job.

B. Compute the total cost of the job, including overhead.

Units produced Machine hours Material moves Setups Deluxe Basic Total 15,000 45,000 60,000 9,000 21,000 30,000 2,000 2,000 4,000 600 400 1,000 Units produced Machine hours Material moves Setups Deluxe 20,000 9,000 2,000 600 Basic 60,000 21,000 2,000 400 Total 80,000 30,000 4,000 1,000

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 c 125000 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60893357510e0_16289.pdf

180 KBs PDF File

60893357510e0_16289.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started