Question

1. The financial statements are the standard measure used by most organizations for the evaluation of management and organization performance. But every aspect of financial

1. The financial statements are the standard measure used by most organizations for the evaluation of management and organization performance. But every aspect of financial performance contained in the financial statements relates to past performance rather than current or future performance. This strict focus only on the past is like driving a car using only the rearview mirror, rather than also using the windshield. Economists refer to past measures as ?lagging indicators? in contrast to ?leading indicators? which correctly predict future measures of performance. Restricting performance measures to the past often means that corrective steps to fix errors and to change course are delayed, and left undone until excessive costs and lost profits have been unnecessarily incurred. Excessive costs and lost profits are expensive, and cannot be afforded in a competitive environment. Organizations need to eliminate these sources of loss.

2. In addition, virtually every large, well-established organization has a planned strategy. Whether the organization is for-profit or not-for-profit, chances are that it has a definite strategy in the form of a well-thought-out strategic plan. That is very commonly the case. What is not usually the case is successful implementation of the planned strategy. Successful implementation of the planned strategy is often the point of failure. In actual practice, it has proven very difficult for organizations to successfully implement, and to continuously execute, their planned strategies. Seasoned strategy consultants will confirm this observation. They will agree that a second-rate strategy with first-rate implementation is rare, and will regularly beat a first-rate strategy with second-rate implementation. If you are skeptical about this observation, just ask any worker how his or her job fits into the overall strategy of the organization where they are employed. The usual response is a blank stare, and a stammered comment that they have little, if any, idea of the answer. While they go about their daily routines with practiced skill, they are normally unaware of how their activities fit into the overall organization strategy. Therefore it is not surprising that many organizations may have sound strategic plans, but that these organizations have rather poor implementation of their planned strategies.

3. The Balanced Scorecard was devised by Robert Kaplan and David Norton in order to overcome these two deficiencies, namely (a) reliance upon the ?lagging indicators? of financial statements for performance evaluation, and (b) the lack of a connection between organization strategy and the daily activities of organization employees. This lack of connection tends to favor daily activities that have no link to strategic objectives.

4. The Balanced Scorecard essentially accomplishes the following key tasks:

a. For the entire organization, strategic objectives are agreed upon for the lagging indicators of the financial statements (known as The Financial Perspective) as well as the leading indicators of The Customer Perspective, The Internal Processes Perspective, and The Organizational Learning and Growth Perspective.

b. These organization-wide strategic objectives are then broken down into the same four lagging and leading perspectives (Financial, Customer, Internal Processes, and Organizational Learning and Growth) for each unit in the organization.

c. For each of the four perspectives (Financial, Customer, Internal Processes, and Organizational Learning and Growth) for each unit in the organization, it is agreed to have at least 3 metrics that measure progress towards agreed objectives.

d. Of course, the three current perspectives (Customer, Internal Processes, and Organizational Learning and Growth)need to be valid leading predictors of the lagging financial results. It takes careful cut and try efforts to find these leading indicators. Further, regular review is required to ensure that they remain valid as time progresses. On the one hand, that makes the Balanced Scorecard rather expensive to install and to maintain. On the other hand, it also makes the Balanced Scorecard effective and successful by ensuring that it keeps working as intended. As a result of the expensive system maintenance required by the Balanced Scorecard, it is normally found only in larger organizations with larger resources, rather than in smaller organizations, which have lesser resources.

e. Given the above considerations, the Balanced Scorecard overcomes the problems of:

? Relying for performance measurement only upon the lagging indicators of financial statements, and delayed corrective actions, rather than also using leading indicators and speedier corrective actions.

? Failing to successfully implement well-thought-out strategic plans, because there is no link between the everyday activities of organization employees and the strategies of their organizational units, which are coordinated with overall organization objectives.

5. Numbers are the language of business. Numbers are measurements of performance for companies, for business units, and for individuals. These performance measurements determine whether companies, business units, and individuals are succeeding or failing in reaching their objectives. If the measurements are favorable, then companies are succeeding, employees are earning increased compensation and greater job security, customers are pleased, suppliers are winning more orders, the local community is benefiting, and investors are earning good returns. However, if the measurements are unfavorable, then companies are not succeeding, employees are earning constant or reduced compensation and losing job security, customers are displeased, suppliers are winning fewer orders, the local community is being harmed, and investors are earning low or even negative returns. Therefore performance measurement numbers are of crucial importance. These performance measurement numbers are known as "metrics."

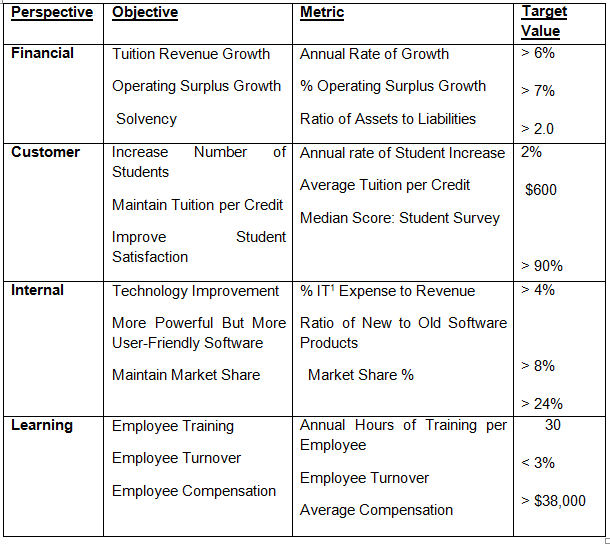

Your assignment should include a table of metrics for your Balanced Scorecard organization. If you would like to see a sample table of metrics, for a college, an example is shown in the table below:

Sample Table of Metrics for an Example College Unit

It is very important to understand what a metric is.To be clear, a metric means a measurement. There are three kinds of measurements:

i) Nominal: a nominal scale assigns items to a category. For example, the category may be a simple "yes" or "no." In the case of a family, a nominal scale assigns items to categories like grandfather, grandmother, father, mother, son or daughter. In the case of an automobile, categories could be small sedan, midsize sedan, large sedan, SUV, etc.

ii) Ordinal: an ordinal scale identifies items in order of magnitude. For example, a customer survey might ask for ratings of service on a scale of 1 through 5, where 5 is best. That means a score of 4 is better than a score of 2. But it does not mean that a 4 is twice as good as a 2, or that a 4 is four times as good as a 1.

iii) Cardinal: a cardinal scale is also known as a ratio scale. For example, the numbers 1, 2, 3, ... represent a cardinal scale. For a cardinal or ratio scale, 12 is four times three, three times four, and two times six.

So a metric must be either a nominal or ordinal or cardinal measurement. Anything else is not a metric.

For example, ?ROE > 20%? is a metric. Also "Increase Sales Revenue by 5%" is a metric.

But "Survey Customers" is not a metric.

Perspective Objective Financial Tuition Revenue Growth Operating Surplus Growth Solvency Increase Number of Annual rate of Student Increase Students Average Tuition per Credit Median Score: Student Survey Customer Internal Learning Maintain Tuition per Credit Improve Student Satisfaction Metric Employee Training Employee Turnover Employee Compensation Annual Rate of Growth % Operating Surplus Growth Ratio of Assets to Liabilities Technology Improvement % IT Expense to Revenue More Powerful But More Ratio of New to Old Software Products User-Friendly Software Maintain Market Share Market Share % Annual Hours of Training per Employee Employee Turnover Average Compensation Target Value > 6% > 7% > 2.0 2% $600 > 90% > 4% > 8% > 24% 30 < 3% > $38,000

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Balance scorecard is basically a strategic planning and management system tool which provides a detail examination of the organization internal resources and the utilization along with the financial m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started