Question

1. Using the following information, determine the activity rate for the Quality Inspections Department. a. $6 b. $100 c. $10 d. $20 2. Lowell Company

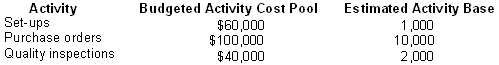

1. Using the following information, determine the activity rate for the Quality Inspections Department.

a. $6

b. $100

c. $10

d. $20

2. Lowell Company owns an office building that is currently being leased for the next 5 years at a monthly amount of $2,000. Lowell Company pays $5,000 of property taxes each year. The company has been approached with an offer to sell the building for an amount of $75,000. Determine the best option for Lowell Company.

a. sell; net income $45,000.

b. continue to lease; net income $20,000.

c. continue to lease; net income $45,000.

d. sell; net income $75,000.

3. Rumba Dance Hall has offered to buy from Muy Bueno Bakery 100 of their chocolate cakes for $25 each. No variable selling costs would need to be paid, but special packaging of $100 will have to be added. Normally, Muy Bueno sells their cakes at $35 each. Their costs per cake are: materials, $12; direct labor, $5; variable factory overhead, $3; fixed factory overhead, $2; and variable selling costs, $4. How much net differential income or loss will Muy Bueno make if they accept this offer?

a. $2,500

b. $400

c. $200

d. $2,400

4. Under the product cost concept, the normal selling price is determined by

a. None of these choices are correct.

b. adding the markup per unit to the product cost per unit.

c. adding the markup per unit to the administrative expenses.

d. subtracting the markup per unit from selling expenses.

5. Which of the following should be used to allocate the cost of the purchasing department?

a. Material costs

b. Number of purchase orders

c. Number of inspections

d. Number of engineering changes

Activity Set-ups Purchase orders Quality inspections Budgeted Activity Cost Pool $60,000 $100,000 $40,000 Estimated Activity Base 1,000 10,000 2,000

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 D 20 400002000 2 B continue to lease net income 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6095f9fb29350_26462.pdf

180 KBs PDF File

6095f9fb29350_26462.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started