Question

1. What is the difference between an accounts payable and a notes payable? Explain 2. How does goodwill arise? How is it accounted for and

1. What is the difference between an accounts payable and a notes payable? Explain

2. How does goodwill arise? How is it accounted for and reported on the financial statements?

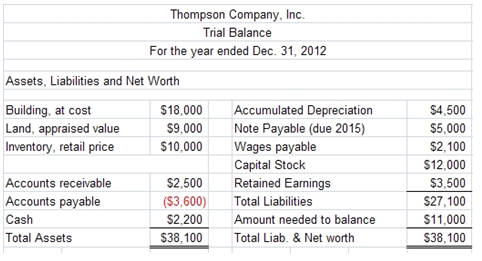

3. The following Classified Balance Sheet has numerous errors. Indicate the errors in this Balance Sheet by preparing a corrected Classified Balance Sheet with all required information.

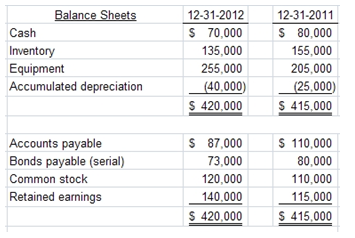

4. Barton Company uses the indirect method of preparing the Statement of Cash Flows and reports the following comparative balance sheet information. As customary, the most recent data is in the first column.

Additional Information:

Net income for 2012 was $30,000.

No equipment was disposed of during 2012.

Required: Prepare a Cash Flow Statement using the indirect method.

Thompson Company, Inc. Trial Balance For the year ended Dec. 31, 2012 Assets, Liabilities and Net Worth Building, at cost Land, appraised value Inventory, retail price Accounts receivable Accounts payable Cash Total Assets $18,000 $9,000 $10,000 $2,500 ($3,600) $2,200 $38,100 Accumulated Depreciation Note Payable (due 2015) Wages payable Capital Stock Retained Earnings Total Liabilities Amount needed to balance Total Liab. & Net worth $4,500 $5,000 $2,100 $12,000 $3,500 $27,100 $11,000 $38,100 Balance Sheets Cash Inventory Equipment Accumulated depreciation Accounts payable Bonds payable (serial) Common stock Retained earnings 12-31-2012 $ 70,000 135,000 255,000 (40,000) $ 420,000 $ 87,000 73,000 120,000 140,000 $ 420,000 12-31-2011 $ 80,000 155,000 205,000 (25,000) $ 415,000 $ 110,000 80,000 110,000 115,000 $ 415,000

Step by Step Solution

3.55 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Accounts payable are amount due to vendors for products or services purchased from them whereas no...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started