Question

1. Which of the following is not an asset utilization ratio? (A) Inventory turnover (B) Return on assets (C) Fixed asset turnover (D) Average collection

1. Which of the following is not an asset utilization ratio?

(A) Inventory turnover

(B) Return on assets

(C) Fixed asset turnover

(D) Average collection period

2. If ABC?s sales are $1,000,000, while accounts receivable is $100,000, inventory is $45,000, and fixed assets are $132,000, what is ABC?s fixed asset turnover?

(A) 7.58

(B) 10.00

(C) 0.13

(D) 22.22

3. If XYZ?s receivables turnover is 4x, what does that mean?

(A) XYZ?s total sales are rotated four times a year.

(B) XYZ has a really good receivables turnover rate.

(C) XYZ is able to collect its receivables every 90 days, or 4 times a year.

(D) XYZ generates four times as much sales through receivables than sales through cash.

4. A decreasing average receivables collection period could be associated with

(A) Increasing sales.

(B) Decreasing sales.

(C) Decreasing accounts receivable.

(D) Increasing sales and decreasing accounts receivable.

5. An increasing average receivables collection period indicates

(A) The firm is generating more income.

(B) Accounts receivable are going down.

(C) The company is becoming more efficient in its collection policy.

(D) The company is becoming less efficient in its collection policy.

6. A firm has operating profit of $210,000 after deducting fixed lease payments of $30,000. The fixed interest expense is $50,000. What is the firm's fixed charge coverage ratio?

(A) 6.00x

(B) 2.33x

(C) 2.00x

(D )3.00x

7.

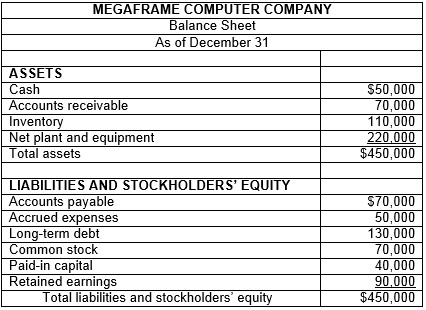

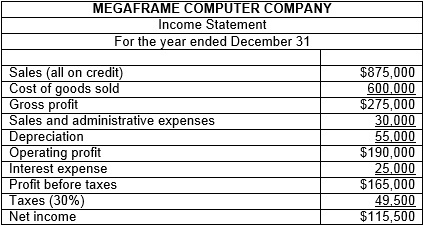

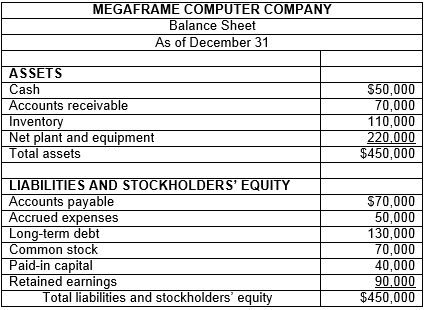

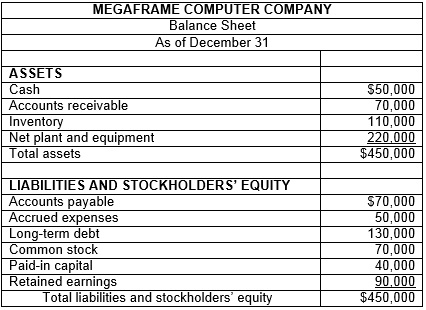

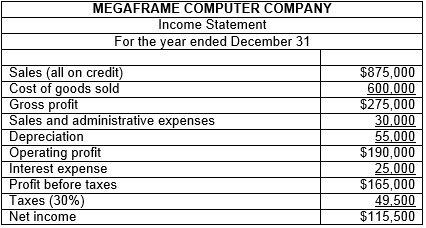

Refer to the tables above. Compute Megaframe's after-tax profit margin.

(A)5.7%

(B)13.2%

(C)15.4%

(D)18.9%

8.

Refer to the tables above. Megaframe's quick ratio is ____.

(A)1.9:1

(B)1:1

(C)1.8:1

(D)12:1

9.

Refer to the tables above. What is Megaframe Computer's total asset turnover?

(A)7.58x

(B)3.6x

(C)2x

(D)1.94x

10.

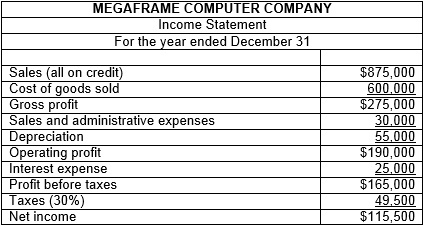

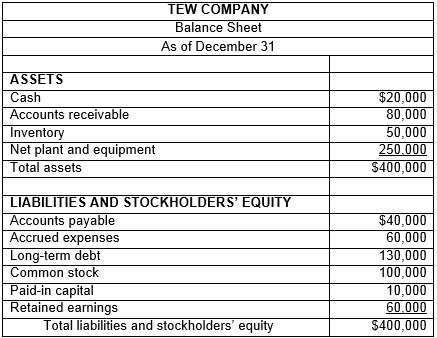

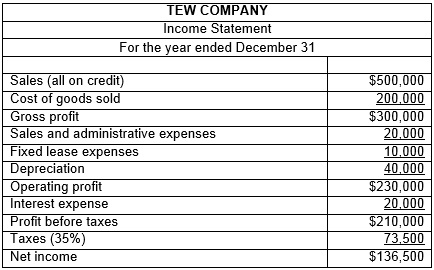

Refer to the tables above. Compute Tew's after-tax profit margin

(A)42.0%

(B)27.3%

(C)59.4%

(D)None of the options

MEGAFRAME COMPUTER COMPANY Balance Sheet As of December 31 ASSETS Cash Accounts receivable Inventory Net plant and equipment Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Accrued expenses Long-term debt Common stock Paid-in capital Retained earnings Total liabilities and stockholders' equity $50,000 70,000 110,000 220,000 $450,000 $70,000 50,000 130,000 70,000 40,000 90,000 $450,000 MEGAFRAME COMPUTER COMPANY Income Statement For the year ended December 31 Sales (all on credit) Cost of goods sold Gross profit Sales and administrative expenses Depreciation Operating profit Interest expense Profit before taxes Taxes (30%) Net income $875,000 600,000 $275,000 30,000 55,000 $190,000 25,000 $165,000 49,500 $115,500 MEGAFRAME COMPUTER COMPANY Balance Sheet As of December 31 ASSETS Cash Accounts receivable Inventory Net plant and equipment Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Accrued expenses Long-term debt Common stock Paid-in capital Retained earnings Total liabilities and stockholders' equity $50,000 70,000 110,000 220,000 $450,000 $70,000 50,000 130,000 70,000 40,000 90,000 $450,000 MEGAFRAME COMPUTER COMPANY Income Statement For the year ended December 31 Sales (all on credit) Cost of goods sold Gross profit Sales and administrative expenses Depreciation Operating profit Interest expense Profit before taxes Taxes (30%) Net income $875,000 600,000 $275,000 30,000 55,000 $190,000 25,000 $165,000 49,500 $115,500 MEGAFRAME COMPUTER COMPANY Balance Sheet As of December 31 ASSETS Cash Accounts receivable Inventory Net plant and equipment Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Accrued expenses Long-term debt Common stock Paid-in capital Retained earnings Total liabilities and stockholders' equity $50,000 70,000 110,000 220,000 $450,000 $70,000 50,000 130,000 70,000 40,000 90,000 $450,000 MEGAFRAME COMPUTER COMPANY Income Statement For the year ended December 31 Sales (all on credit) Cost of goods sold Gross profit Sales and administrative expenses Depreciation Operating profit Interest expense Profit before taxes Taxes (30%) Net income $875,000 600,000 $275,000 30,000 55,000 $190,000 25,000 $165,000 49,500 $115,500 ASSETS Cash Accounts receivable Inventory Net plant and equipment Total assets TEW COMPANY Balance Sheet As of December 31 LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Accrued expenses Long-term debt Common stock Paid-in capital Retained earnings Total liabilities and stockholders' equity $20,000 80,000 50,000 250.000 $400,000 $40,000 60,000 130,000 100,000 10,000 60.000 $400,000 TEW COMPANY Income Statement For the year ended December 31 Sales (all on credit) Cost of goods sold Gross profit Sales and administrative expenses Fixed lease expenses Depreciation Operating profit Interest expense Profit before taxes Taxes (35%) Net income $500,000 200,000 $300,000 20,000 10,000 40,000 $230,000 20,000 $210,000 73,500 $136,500

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 B Return on assets Return on assets ROA is an indicator of a firms ability to generate earnings Ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started