Question

A company enters into a contract to purchase a certain quantity of goods from another company during the following month. At this point, would a

- A company enters into a contract to purchase a certain quantity of goods from another company during the following month. At this point, would a liability exist? Explain why or why not?

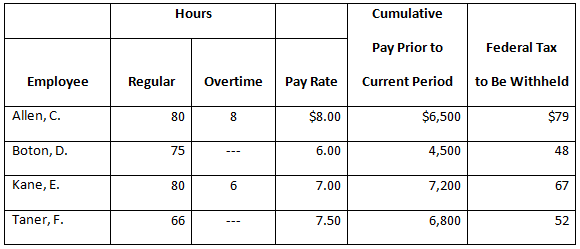

- Flavin Distributors has four employees, who are paid every two weeks. The employees are paid an hourly rate, which is indicated below, and time-and-a-half for hours worked over 80 for a two-week period. In addition, both employees and employer are subject to a 6.2 percent social security tax and a 1.45 percent Medicare tax per employee. Finally, Flavin must pay 5.4 percent state unemployment and .8 percent federal unemployment insurance taxes for the first $7,000 earned by each employee. The following additional information is available:

a) Complete the payroll register.

b) In the journal provided, record the payroll for the above two-week period.

c) In the journal provided, make the entry that records payroll tax expense and related liabilities.

3. Canseco Company is preparing the annual financial statements on December 31, 1992. During 1992, a customer fell while riding on the escalator and has filed a lawsuit for $40,000 because of a claimed back injury. The lawyer employed by the company has carefully assessed all of the implications. If the suit is lost, the lawyer?s reasonable estimate is that the $40,000 will be assessed by the court.

Required: How should the contingency be handled during 1992 in each of the following cases? Give all necessary entries and/or any notes.

a) Assume that the lawyer and the management concluded that it is reasonably possible that the company will be liable, and it is reasonably estimated that the amount will be $40,000.

b) Assume, instead, that the lawyer, the independent accountant, and management have reluctantly concluded that it is probable that the suit will be successful.

c) Assume that the conclusion of the legal counsel and management is that it is remote that there will be a contingency loss. They believe the suit is without merit.

Employee Allen, C. Boton, D. Kane, E. Taner, F. Regular Hours 80 75 80 66 Overtime 8 6 1 Pay Rate $8.00 6.00 7.00 7.50 Cumulative Pay Prior to Current Period $6,500 4,500 7,200 6,800 Federal Tax to Be Withheld $79 48 67 52

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Yes The liability does exist Both parties by a mutual agreement entered into a contract which lega...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started