Question

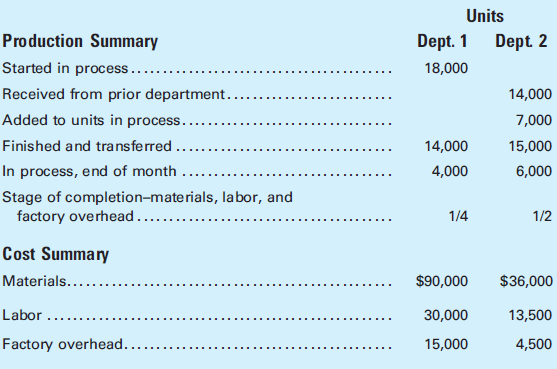

A company manufactures a liquid product called Crystal. The basic ingredients are put into process in Department 1. In Department 2, other materials are added

A company manufactures a liquid product called Crystal. The basic ingredients are put into process in Department 1. In Department 2, other materials are added that increase the number of units being processed by 50%. The factory has only two departments

Calculate the following for each department:

(a) Unit cost for the month for materials, labor, and factory overhead,

(b) Cost of the units transferred, and

(c) Cost of the ending work in process.Production Summary Started in process... Received from prior department.... Added to units in process.... Finished and transferred ..... In process, end of month.... Stage of completion-materials, labor, and factory overhead...... Cost Summary Materials........ Labor.... Factory overhead....... Units Dept. 1 Dept. 2 18,000 14,000 4,000 1/4 $90,000 30,000 15,000 14,000 7,000 15,000 6,000 1/2 $36,000 13,500 4,500

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Cost Accounting

Authors: Edward J. Vanderbeck, Maria Mitchell

17th edition

9781305480520, 1305087402, 130548052X, 978-1305087408

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App