Question

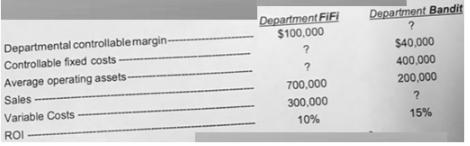

A. Fluffy Company has two investment centers and has developed the following information: 1. What was the amount of Department FIFIs controllable fixed costs? 2.

A. Fluffy Company has two investment centers and has developed the following information:

1. What was the amount of Department FIFIs controllable fixed costs?

2. If department FIFI is able to reduce its variable costs by $20,000. Department FIFI's new ROI would be.

3. What was the amount of Department Bandit's variable costs?

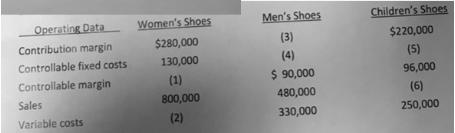

B. QQ Co. has three divisions which are operated as profit centers. Actual operating data for the divisions listed alphabetically are follows.

Compute the missing amounts. Show computations.

Department FIFI $100,000 Department Bandit Departmental controllablemargin- Controllable fixed costs $40,000 Average operating assets 400,000 Sales - 700,000 200,000 Variable Costs 300,000 ROI 10% 15%

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Contribution margin Income statement is as following format Sales XY Variables Costs XX Contribution Margin XX Controllable fixed costs XX Controllabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6096f7a2c3208_27364.pdf

180 KBs PDF File

6096f7a2c3208_27364.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started