A summary of Entity A's operations is presented below (amts in millions). A. You have been asked to help formulate a cash dividend police for

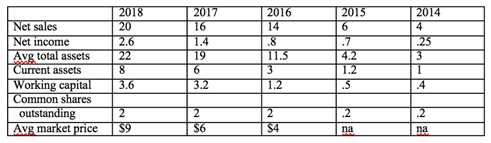

A summary of Entity A's operations is presented below (amts in millions).

A. You have been asked to help formulate a cash dividend police for this tech company which went public in 2016. The principal in charge of the engagement suggested.

Computing the following rations for each year.

1. Return on assets (express as percentage, e.g. 5.23%)

2. Profit margin (same as above)

3. EPS

4. Price / earnings

5. Current ratio

B. She than asked you what factors the board should consider in setting a dividend policy. Shc explained that the founding principal stockholders (3), all board members and high net-worth individuals, have relied on retained earnings to finance expansion and are concerned about having the cash to pay dividends on a regular basis. One of the principals discussed this with his accountant who mentioned something about a stock dividend. Another principal suggested that not declaring a cash dividend is holding the stock price back. Discuss the various factors the board might want to consider in setting a dividend policy. Does the firm's performance justify a dividend? C. Suggest a cash amount per share for the dividend and justify your choice. Explain what the dividend payout ratio would have been in 2018 under your suggestion, as well as the dividend yield based on the average market price of the stock in 2018.

Net sales Net income Avg total assets Current assets Working capital Common shares outstanding Avg market price 2018 20 2.6 22 8 3.6 2 $9 2017 16 1.4 19 6 3.2 2 $6 2016 14 .8 11.5 3 1.2 2 $4 2015 6 .7 4.2 1.2 .5 .2 na 2014 4 25 | 3 1 4 .2 na

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculation of Ratios for each year 2018 2017 2016 2015 2014 Return on Assets Net Income 26 14 08 07 ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards