Question

a. The Capital Asset Pricing Model (CAPM) is a widely used concept in finance. The Model is expressed graphically by the Security Market Line (SML).

a. The Capital Asset Pricing Model (CAPM) is a widely used concept in finance. The Model is expressed graphically by the Security Market Line (SML). Within the context of investment, explain how CAPM can be useful to investors.

b. Explain Efficient Market Hypothesis (EMH) and the different types of market efficiency. Do stock market anomalies contradict the concept of market efficiency? Explain.

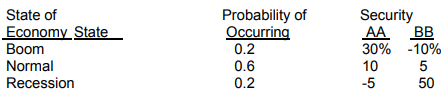

c. The distributions of rates of return for Security AA and Security BB are given below:

Based on the above information can we conclude that any rational risk-averse investor will add Security AA to a well-diversified portfolio over Security BB. Why? Or why not?

State of Economy State Boom Normal Recession Probability of Occurring 0.2 0.6 0.2 Security AA BB 30% -10% 10 5 -5 50

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a The Capital Asset Pricing Model CAPM is an equilibrium model which specifies the relationship between risk and required rates of return on assets wh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started