Answered step by step

Verified Expert Solution

Question

1 Approved Answer

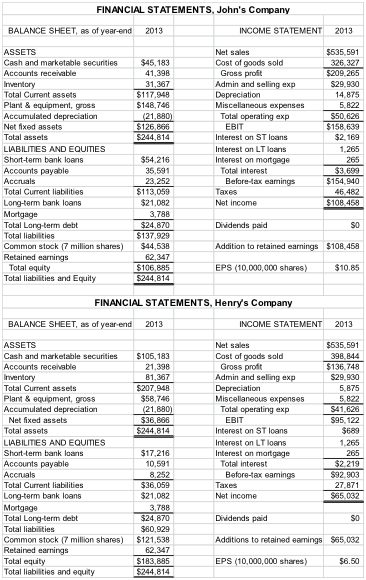

a. To which firm would you prefer to lend money? Why? (Justify your answer with at least two ratios). b. In which firm would you

a. To which firm would you prefer to lend money? Why? (Justify your answer with at least two ratios).

b. In which firm would you prefer to invest? Why? (Justify your answers with at least two ratios).

BALANCE SHEET, as of year-end 2013 ASSETS Cash and marketable securities Accounts receivable Inventory Total Current assets Plant & equipment, gross Accumulated depreciation Net fixed assets Total assets LIABILITIES AND EQUITIES Short-term bank loans Accounts payable Accruals FINANCIAL STATEMENTS, John's Company Total Current liabilities Long-term bank loans Mortgage Total Long-term debt Total liabilities Common stock (7 million shares) Retained earnings Total equity Total liabilities and Equity ASSETS Cash and marketable securities Accounts receivable Inventory Total Current assets Plant & equipment, gross Accumulated depreciation Net fixed assets Total assets Total Current liabilities Long-term bank loans Mortgage LIABILITIES AND EQUITIES Short-term bank loans Accounts payable Accruals Total Long-term debt Total liabilities BALANCE SHEET, as of year-end 2013 $45,183 41,398 31,367 $117.948 $148,746 Common stock (7 million shares) Retained earnings Total equity Total liabilities and equity (21,880) $126,866 $244,814 $54,216 35,591 23,252 $113,059 $21,082 3,788 $24,870 $137.929 $44,538 62,347 $106,885 $244,814 FINANCIAL STATEMENTS, Henry's Company $105,183 21,398 81,367 $207,948 $58,746 (21,880) $36,866 $244,814 $17,216 10,591 8,252 $36,059 $21,082 3,788 $24,870 $60,929 $121,538 62,347 INCOME STATEMENT 2013 $535,591 326,327 $209,265 $29,930 14.875 5,822 $183,885 $244,814 Net sales Cost of goods sold Gross profit Admin and selling exp Depreciation Miscellaneous expenses Total operating exp EBIT Interest on ST loans Interest on LT loans Interest on mortgage Total interest Before-tax eamings Taxes Net income INCOME STATEMENT Net sales Cost of goods sold Gross profit Admin and selling exp Dividends paid Addition to retained earnings $108,458 EPS (10,000,000 shares) Depreciation Miscellaneous expenses Total operating exp EBIT Interest on ST loans Interest on LT loans Interest on mortgage Total interest Before-tax eamings $50,626 $158,639 $2,169 Taxes Net income 1,265 265 $3,699 $154,940 46.482 $108,458 SO $10.85 2013 $535,591 398,844 $136,748 $29,930 5,875 5,822 $41,626 $95, 122 $689 1,265 265 $2,219 $92,903 27,871 $65,032 Dividends paid Additions to retained eamings $65,032 EPS (10,000,000 shares) SO $6.50

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a To which firm would you prefer to lend money Why Justify your answer with at least two ratios I ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60955820d465b_25781.pdf

180 KBs PDF File

60955820d465b_25781.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started