Question

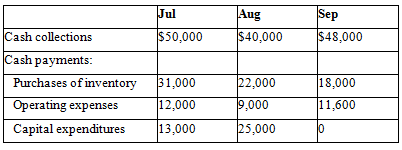

AAA Company is preparing its 3rd quarter budget and provides the following data: Cash balance at June 30 is projected to be $4,000. The company

AAA Company is preparing its 3rd quarter budget and provides the following data:

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

What is the projected cash shortfall at the end of August, before financing transactions have been taken into consideration?

A) $0

B) $5,000

C) $3.000

D) $8,000

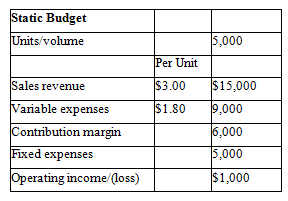

Portobello Company prepared the following static budget for the coming month:

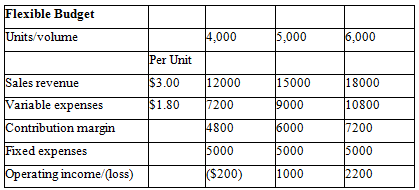

Using the format below, please prepare a flexible budget including data at volumes of 4,000 and 6,000 units.

Which of the following BEST describes sales volume variance?

A) Difference between actual amounts and the flexible budget due to differences in price and costs

B) Difference between the flexible budget and static budget due to differences in volumes

C) Difference between the static budget and actual amounts due to differences in price

D) Difference between the flexible budget and static budget due to differences in fixed expenses

Which of the following BEST describes flexible budget variance?

A) Difference between actual amounts and the flexible budget due to differences in price and costs

B) Difference between the flexible budget and static budget due to differences in volumes

C) Difference between the flexible budget and actual amounts due to differences in volumes

D) Difference between the flexible budget and static budget due to differences in fixed expenses

Onyx Company prepared a static budget at the beginning of the month. It's the end of the month and the company is analyzing actual results versus budget using flexible budget methodology. Data are as follows:

Static budget: Sales volume: 1,000 units Price: $70 per unit

Variable expense: $32 per unit Fixed expenses: $37,500 per month

Operating income: $500

Actual results: Sales volume: 990 units Price: $74 per unit

Variable expense: $35 per unit Fixed expenses: $33,000 per month

Operating income: $5,610

Based on the above data, how much was the flexible budget variance for sales revenue?

A) $5,490 U

B) $5,490 F

C) $3,960 U

D) $3,960 F

Onyx Company prepared a static budget at the beginning of the month. At the end of the month, the company is analyzing actual results versus budget using flexible budget methodology. Data are as follows:

Static budget: Sales volume: 1,000 units Price: $70 per unit

Variable expense: $32 per unit Fixed expenses: $37,500 per month

Operating income: $500

Actual results: Sales volume: 990 units Price: $74 per unit

Variable expense: $35 per unit Fixed expenses: $33,000 per month

Operating income: $5,610

Based on the above data, how much was the flexible budget variance for variable expenses?

A) $5,490 U

B) $2,970 U

C) $2,970 F

D) $3,960 F

Corporate divisions, like the media division of Amazon.com, are normally considered:

A) cost centers.

B) revenue centers.

C) profit centers.

D) investment centers.

Which of the following statements BEST describes the responsibilities of the head of an investment center?

A) He or she is mainly responsible for controlling costs.

B) He or she is responsible for maximizing income and using assets efficiently.

C) He or she is responsible chiefly for achieving as much operating income as possible.

D) He or she is responsible solely for the efficient and productive use of invested assets.

An investment center is responsible for new investments. Which of the following is a good example of the kind of investments for which an investment center is responsible?

A) Purchasing raw materials for production

B) Creating a new product line with separate manufacturing facilities

C) Replacing worn-out manufacturing equipment

D) Performing maintenance work on facilities

Parkinson Company provides the following financial data:

| Income from operations | $200,000 |

| Interest expense | $45,000 |

| Gains/(losses) on sale of equipment | ($2,500) |

| Net income | $152,500 |

| Total assets at Jan 1 | $2,600,000 |

| Total assets at Dec 31 | $3,200,000 |

How much is the return on investment?

A) 6.3%

B) 5.3%

C) 6.9%

D) 7.2%

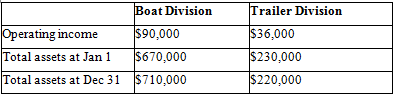

Recreation Equipment Company has several divisions which are investment centers. Data for the Boat Division and the Trailer Division are shown here:

Which of the following statements would be the MOST meaningful interpretation of this data?

A) The performance of the Boat Division is better than the Trailer Division because the Boat Division has higher assets.

B) The Trailer Division shows a more efficient use of assets than the Boat Division because it has a higher ROI.

C) The Boat Division shows a more efficient use of assets than the Trailer Division because it has a higher operating income.

D) The Boat Division was more successful financially than the Trailer Division because it shows an increase in assets as contrasted to a reduction of assets in the Trailer Division.

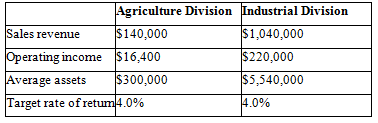

Huntswell Corporation has two major divisions: Agricultural Products and Industrial Products. Data for the year just finished is as follows:

For the Agricultural Division, how much is the profit margin?

A) 10.5%

B) 11.1%

C) 11.4%

D) 11.7%

Aitkins, Ryalls and Fogelin have a partnership that splits income equally. During the year 2012, the following items were included in the net income of the partnership:

Service Revenue: $210,000

Staff salaries and benefits: $106,000

Office rent and utilities: $ 23,000

Other admin. expenses: $ 9,000

Please prepare an income statement in the format below:

| Service revenues |

| $210,000 |

| Salaries and benefits |

| $106,000 |

| Rent and utilities |

| $ 23,000 |

| Other |

| $ 9,000 |

| Net income |

| $348,000 |

|

|

|

|

| Allocation: |

|

|

| Aitkins |

| $116,000 |

| Ryalls |

| $116,000 |

| Fogelin |

| $116,000 |

| Total allocated |

| $348,000 |

McCall, Crenshaw, and Samuels have a partnership which shares profits and losses in a ratio of 1:2:2 respectively. During the year 2012, the following items were included in the net income of the partnership:

Service revenue: $90,000

Staff salaries and benefits: $42,000

Office rent and utilities: $12,000

Other admin.expenses $24,000

Please prepare an income statement in the format below:

| Service revenues |

| $90,000 |

| Salaries and benefits |

| $42,000 |

| Rent and utilities |

| $12,000 |

| Other |

| $24,000 |

| Net income |

| $168,000 |

|

|

|

|

| Allocation: |

|

|

| McCall |

| $33,600 |

| Crenshaw |

| $67,200 |

| Samuels |

| $67,200 |

| Total allocated |

| $168,000 |

Cash collections Cash payments: Purchases of inventory Operating expenses Capital expenditures Jul $50,000 31,000 12,000 13,000 Aug $40,000 22,000 9,000 25,000 Sep $48,000 18,000 11,600 10 Static Budget Units/volume Sales revenue Variable expenses Contribution margin Fixed expenses Operating income/(loss) Per Unit $3.00 $1.80 5,000 $15,000 9,000 6,000 5,000 $1,000 Flexible Budget Units/volume Sales revenue Variable expenses Contribution margin Fixed expenses Operating income/(loss) Per Unit $3.00 $1.80 4,000 12000 7200 4800 5000 ($200) 5,000 15000 9000 6000 5000 1000 6,000 18000 10800 7200 5000 2200 Operating income Total assets at Jan 1 Total assets at Dec 31 Boat Division $90,000 $670,000 $710,000 Trailer Division $36,000 $230,000 $220,000 Agriculture Division Industrial Division $140,000 $1,040,000 $16,400 $220,000 $300,000 $5,540,000 Sales revenue Operating income Average assets Target rate of retum 4.0% 4.0%

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A AAA Company Schedule of Cash receipts and payments July August Beginning Cash balance 4000 7979 Fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started