Question

Acoms is a small busi9ness with limited liability. Its financial results are given below: Financial Statement Analysis Additional Information The follwing are ratios for acoms

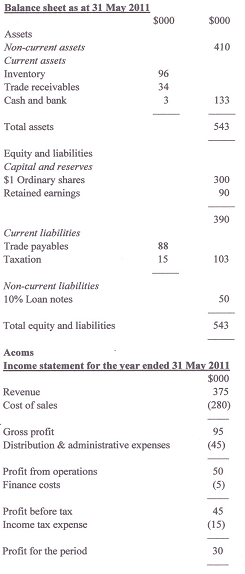

Acoms is a small busi9ness with limited liability. Its financial results are given below:

Financial Statement Analysis

Additional Information

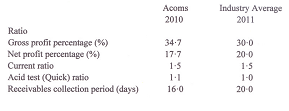

The follwing are ratios for acoms for the year 31 May 2010 and the industry average ratios for 2011:

Required:

(a) Calculate the following ratios for Acoms for the year ended 31 May 2011. State clearly the formula used for each ratio.

(i) Gross profit percentage.

(ii) Net profit percentage

(iii) Current ratio

(iv) Acid test (Quick) ratio

(v) Receiveables collection period (10 Marks)

(b) Use the information given and the ratios you calculated in part (a) to comment on the performance of Acoms. (14 marks)

(c) State three limitations of ratio analysis (6 marks)Balance sheet as at 31 May 2011 Assets Non-current assets Current assets Inventory Trade receivables Cash and bank Total assets Equity and liabilities Capital and reserves $1 Ordinary shares Retained earnings Current liabilities Trade payables Taxation Non-current liabilities 10% Loan notes Total equity and liabilities Revenue Cost of sales $000 Profit from operations Finance costs 96 34 3 Profit before tax Income tax expense Profit for the period 88 15 Gross profit Distribution & administrative expenses $000 410 133 543 300 90 390 Acoms Income statement for the year ended 31 May 2011 $000 375 (280) 103 50 543 95 (45) 50 (5) 45 (15) 30 Ratio Gross profit percentage (%) Net profit percentage (%) Current ratio Acid test (Quick) ratio Receivables collection period (days) Acoms 2010 34.7 17.7 1-5 1.1 16.0 Industry Average 2011 30-0 20-0 1-5 1-0 20-0

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a i Gross Profit Percentage Gross ProfitNet Sales100 95375100 2533 ii Net Profit Percentage Net Prof...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started