Question

Activity 1 OPERATING ACTIVITIF s Purpose: ? Understand operating activities on the statement of cash flows. Q. l Operating activities include cash transaction that primarily

Activity 1 OPERATING ACTIVITIF s

Purpose: ? Understand operating activities on the statement of cash flows.

Q. l Operating activities include cash transaction that primarily affect (rarest asset / long-term asset/ Current liability / long-term liability / stockholders' equity) accounts. (Circle all that apply)

Q. 2 Identify transactions recorded in the operating section al the statement of cash flows.

(Operating / Not) a. Receive cash from customers paying on account.

(Operating / Not) b. Pay rent for the nest accounting period.

(Operating / NOt) c. Receive the utility bill for this accounting period that will be paid next accounting period.

(Operating / Not) d. Extend $100,000 of credit to Supplier Barry for a purchase.

(Operating / Not) e. Receive interest payment of $8,000 from Supplier Barry.

(Operating / Not) I. Supplier Barry pays off the $100,000.

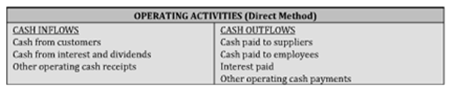

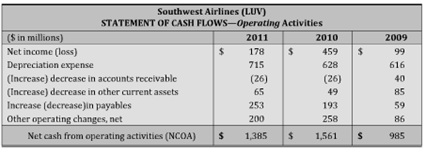

The operating activity section on the face of the statement of cash flows can be reported using the direct or the indirect method. The direct method reports sources and uses of cash during the accounting period. The Indirect method reconciles accrual-based "Net Income" to cash-based "Net Cash from Operating Activities."

Refer to the Information immediately above to answer he following questions.

Q.3 Cash Rows from operating activities is reported using the (direct / Indirect) method.

Q.4 The strongest year for LUV was (2011/ 2010/ 2009). Why?

Q.5 The weokest year tor LUV was 12011/ 2010/ 2009). Why?

Q.6 LUV operates all (Boeing /Airbus / Raytheon) aircraft. Why?

(Hint Refer to company desaiptions In Appendix A?Featured Corporations)

Activity 2. Analysis of Dine Equity

Purpose: ? Understand and interpret amounts reported on the statement of cash flows:

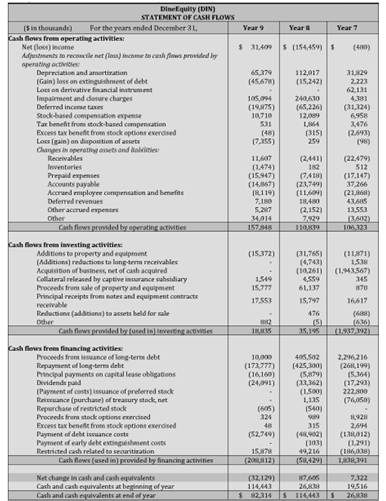

Q.1 In Year 8 the primary source of cash is (operating / investing / financing) activities, which typically indicates a (strong / weak) cash position.

Q.2 In Year 8, DineEquity purchased property and equipment for $________thousand in cash and sold property and equipment for $_________ thousand in cash. Therefore, the company (purchased / sold) more property and equipment, which could indicate this business is (expanding / down-sizing).

Q.3 DineEquity acquired Applebee's in Year (9/ 8 / 7).

How much did the company pay to acquire Applebee's? $_________ thousand.

This acquisition was primarily financed by (operating cash flow / the issuance of debt / the Issuance of stock).

Q.4 DineEquity borrowed more long-term debt than it repaid during Year (9 / 8 / it, . assumption of (more / less) financial risk.

Q.5 DineEquity issued preferred stock during Year (9/ 8/ 7).

Q.6 DineEqurty purchased treasury stock during Year (9 / 8 / 7).

This Is generally considered (favorable / unfavorable) to stockholders. Why?

Q.7 DineEquity reissued treasury stock during Year (9 / 8 / 7).

Q.8 DineEquity (dues/ does not) pay dividends.

Q/9 In Year 8, DineEquity reported (Net income / a Net loss) of $________thousand. However, the company reported cash (Inflows / outflows) from operations. This disparity was primarily caused by (Depredation and amortization / Payment of dividends / Impairment and closure charges). (Circle all that apply)

Q.10 At December 31, Year 9, DineEquity had $________thousand In cash and cash equivalents.

Q.11 DineEquity reports a (strengthening / weakening) cash position. How con you tell? Support your response with at least five observations.

OPERATING ACTIVITIES (Direct Method) CASH OUTFLOWS Cash paid to suppliers Cash paid to employees CASH INFLOWS Cash from customers Cash from interest and dividends Other operating cash receipts Interest paid Other operating cash payments Southwest Airlines (LUV) STATEMENT OF CASH FLOWS-Operating Activities ($ in millions) Net income (loss) Depreciation expense (Increase) decrease in accounts receivable (Increase) decrease in other current assets Increase (decrease)in payables Other operating changes, net Net cash from operating activities (NCOA) $ 2011 178 715 (26) 65 253 200 1,385 $ $ 2010 459 628 (26) 49 193 258 1,561 $ S 2009 99 616 40 85 59 86 985 For the years ended December 31, DineEquity (DIN) STATEMENT OF CASH FLOWS ($in thousands) Cash flows from operating activities: Net (loss) Income Adjustments to reconcile net (less) income to cash flows provided by operating activities: Depreciation and amortization (Gain) loss on extinguishment of debt Lots on derivative financial instrument Impairment and closure charges Deferred income taxes Stock-based compensation expense Tax benefit from stock-based compensation Excess tax benefit from stock options exercised Loss (gain) on disposition of assets Changes in operating assets and liabilities: Receivables Inventories Prepaid expenses Accounts payable Accrued employee compensation and benefits Deferred revenues Other accrued expenses Other Cash flows provided by operating activities. Cash flows from investing activities: Additions to property and equipment (Additions) reductions to long-term receivables Acquisition of business, net of cash acquired Collateral released by captive insurance subsidiary Proceeds from sale of property and equipment Principal receipts from notes and equipment contracts receivable Reductions (additions) to assets held for sale Other Cash flows provided by (used in) investing activities Cash flows from financing activities: Proceeds from issuance of long-term debt Repayment of long-term debt Principal payments on capital lease obligations Dividends paid (Payment of costs) issuance of preferred stock Reissuance (purchase) of treasury stock, net Repurchase of restricted stock Proceeds from stock options exercised Excess tax benefit from stock options exercised Payment of debt issuance costs Payment of early debt extinguishment costs Restricted cash related to securitization Cash flows (used in) provided by financing activities Net change in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Year 9 $ 31,409 (45,678) 105,094 (19,875) 10,710 531 (48) (7,355) 11,607 (1474) (15,947) (14,867) (8,119) 7,180 5,287 34,014 157848 (15,372) 1,549 15,777 17,553 18815 (605) 324 48 (52,749) 15,878 (208812) Year 8 (32,129) 114,443 $ (154,459) $ (480) 112,017 (15,242) 240,430 (65,226) 12,099 1,964 (315) 259 (2,441) 182 (7,418) (23,749) (11,609) 18,480 (2,152) 7,929 110,819 (31,765) (10,261) 4,559 61,137 15,797 476 10,000 405,502 (173,777) (425,300) (16,160) (5,879) (24,091) (5) 35,195 (33,362) (1,500) 1,135 (540) 315 (48,902) (103) 49,216 (58,429) Year 7 31,829 2,223 62,131 87,605 26,838 $ 82.314 $ 114,443 $ 4,381 (31,324) 6,958 3,476 (2,693) (98) (22,479) 512 (17,147) 37,266 (21,868) 43,685 13,553 (3,602) 106,323 (11,871) 1,538 (1,943,567) 345 870 16,617 (688) (636) (1,937,392) 2,296,216 (268,199) (5,364) (17,293) 222,800 (76,050) 8,928 2,694 (138,012) (1291) (186,038) 1,838,391 7,322 19516 26,38

Step by Step Solution

3.51 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Activity 1 OPERATING ACTIVITIF s Purpose Understand operating activities on the statement of cash flows Q l Operating activities include cash transaction that ptimarily affect Current asset longterm a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started