Alfred has carved out a long and successful career as a human factors engineer with an integrated oil and gas company, Shale plc. The company

Alfred has carved out a long and successful career as a human factors engineer with an integrated oil and gas company, Shale plc. The company has been under duress since WTI oil prices plunged from a peak of $107.45 per barrel in June 2014 to a low of $29.01 per barrel in January 2016. Although prices have recovered modestly, the general industry consensus is that prices will be ?lower for longer? and Shale plc has been looking to trim excess fat in its operations.

In the past, Alfred was extremely conservative in his outlook and consciously plans for the future but, after his wife died three years ago due to a tragic car accident, he has been living life in the fast lane and firmly believes YOLO. He recently celebrated his 55th birthday with his only child, Isabelle, who is starting a four-year university program, with tuition and associated expenses estimated to be $40,000 a year. During her time at the university, she plans to run an artisanal cafe? that requires an annual operating lease of $180,000 and other yearly operating costs of $70,000, but is expected to generate revenues of $330,000 per year. These annual cash flows are subject to income taxes and begin in a year but fitting-out costs for the cafe? of $120,000 will be incurred immediately. Isabelle is asking for Alfred?s support for half of the operating lease expenses and will proceed to run the cafe? if her return on investment is at least 10% per year.

As Alfred was mildly inebriated during his birthday celebration, he promised his daughter not only to fund her university-related expenses but also to financially support her cafe? venture as requested. He does not expect any return on these investments. The good news is that Alfred?s annual income is $500,000 and is expected to increase by 5% per year. His annual living expenses is $100,000, expected to increase at the inflation rate of 3% per year. Alfred also makes annual payments of $200,000 towards an outstanding mortgage loan that will be fully paid off just when he turns 65, which is also when he will retire.

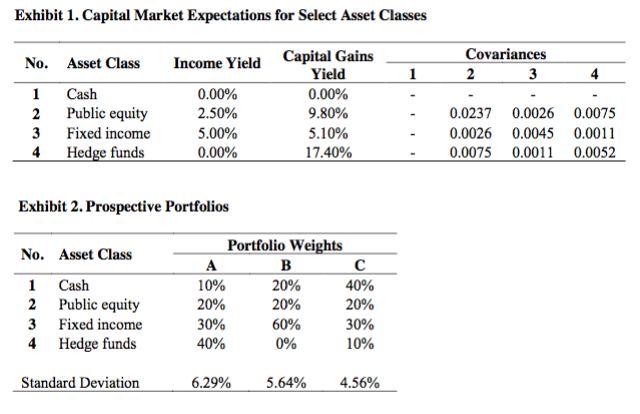

To date, Alfred has accumulated an investable wealth of $1,000,000 and would like his portfolio (excluding the value of his home) to grow to $3,000,000 by the time he retires. He insists that cash flow requirements not be funded by selling securities. You gather and present pertinent information about select asset classes and possible portfolios in Exhibits 1 and 2, respectively. Income and capital gains are taxed at 25% and 15%, respectively.

1) Analyse whether Isabelle should proceed with her artisanal cafe? venture.

2) Using your answer to Question 1, estimate the return requirement for Alfred?s portfolio.

3)

(a) Compute the expected returns for each of the three (3) possible portfolios. State assumptions made, if any.

(b) Construct a return correlation matrix for the non-cash asset classes.

(c) Develop a portfolio for Alfred and justify your recommendation.

Exhibit 1. Capital Market Expectations for Select Asset Classes Capital Gains Yield 0.00% 9.80% 5.10% 17.40% No. Asset Class 1 Cash 2 Public equity Fixed income 3 4 Hedge funds Exhibit 2. Prospective Portfolios No. Asset Class 1 Cash 2 Public equity 3 Fixed income 4 Hedge funds Income Yield 0.00% 2.50% 5.00% 0.00% Standard Deviation A 10% 20% 30% 40% Portfolio Weights B 20% 20% 60% 0% 6.29% 40% 20% 30% 10% 5.64% 4.56% 1 Covariances 2 3 4 0.0237 0.0026 0.0075 0.0026 0.0045 0.0011 0.0075 0.0011 0.0052

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Q1 If we consider the initial cash requirement then cash flow Initial cash flow 120000 Annual Exp180...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609a21b6e7d68_30316.pdf

180 KBs PDF File

609a21b6e7d68_30316.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started