Question

An investor is considering allocating 510,000 among five investment alternatives. The five alternatives and their respective fund categories, risk levels, and average annual returns are

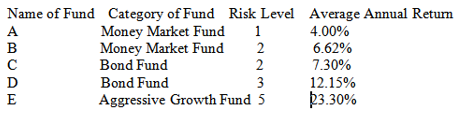

An investor is considering allocating 510,000 among five investment alternatives. The five alternatives and their respective fund categories, risk levels, and average annual returns are given in the data file.

The risk level of each investment is rated on a scale of 1 to 5, where 1 is very conservative and 5 is very risky. The investor would like to maximize the average annual return on his investment subject to the following restrictions;

1. The average risk level of the entire investment should not exceed r.

2. At least a% of the investment should be placed in money market funds.

3. At most Sb should be invested in the aggressive growth fund.

r, a, and b are also given in the data file.

Construct and solve a linear optimization model to determine the optimal allocation of the investor's money.

Please set total profit as your objective. Round off your optimal profit to two decimal places when submitting your solution online.

Data set:

Max average risk level allowed (r): 4

Min percentage placed in money market finds (a) 30

Max amount to invest in aggressive growth fund (b) 3000

Name of Fund Category of Fund Risk Level Average Annual Return 4.00% Money Market Fund Money Market Fund Bond Fund 6.62% 7.30% Bond Fund 12.15% 23.30% ABCDE 12235 2 2 Aggressive Growth Fund 5

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

I am not interested in the final answer I onty want to know the correct way to set up my spreadsheet ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6095453540137_25701.pdf

180 KBs PDF File

6095453540137_25701.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started