Question: Argyle Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000

Argyle Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Variable and fixed expenses are as follows:

Variable: Power cost (40% of Sales)

Miscellaneous expenses (5% of Sales)

Fixed: Salary expense: $8,000 per month

Rent expense: $5,000 per month

Depreciation expense: $1,200 per month

Power cost/fixed portion: $800 per month

Miscellaneous expenses/fixed portion: $1,000 per month

How much is the total operating expense for January?

A) $38,500

B) $47,500

C) $41,700

D) $43,000

Total Operating Expense in March = $ 38,500

Bartholomew Manufacturing Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Cost of goods sold is budgeted at 40% of Sales. Variable and fixed expenses are as follows:

Variable: Miscellaneous expenses: 20% of Sales

Fixed: Salary expense: $11,000 per month

Rent expense: $5,000 per month

Depreciation expense: $1,200 per month

Miscellaneous expenses/fixed portion: $3,300 per month

How much is the operating net income/(loss) for January?

A) $3,500

B) $1,450

C) ( $500)

D) $7,500

Dahl Manufacturing is making its operating budget for the 4th quarter of 2012. Sales are forecast at $60,000 in October, $65,000 in November, and $70,000 in December. Cost of goods sold it 40% of sales. Expenses are budgeted as follows:

Variable: Miscellaneous: 5% of sales

Fixed: Salary expense: $12,600 per month

Rent expense: $5,200 per month

Depreciation expense: $4,000 per month

Admin expense: $5,000 per month

How much are the total operating expenses in December?

A) $29,800

B) $30,300

C) $30,050

D) $29,990

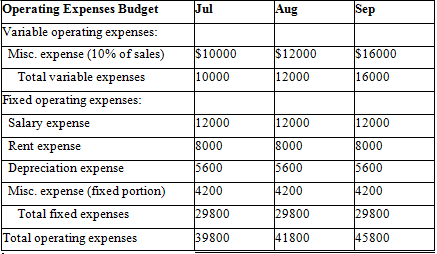

Hi-value Products Company is creating an operating budget for the 3rd quarter, and is now preparing the operating expense budget. Assumptions for operating expenses are as follows:

Miscellaneous expense ? variable portion: 10% of sales revenue

Miscellaneous expense ? fixed portion: $4,200 per month

Salary expense ? fixed: $12,000 per month

Rent expense ? fixed: $8,000 per month

Depreciation expense ? fixed: $5,600 per month

Sales for July, August and September were budgeted at $100.000, $120,000, and $160,000.

Using the format below, please prepare an operating expense budget

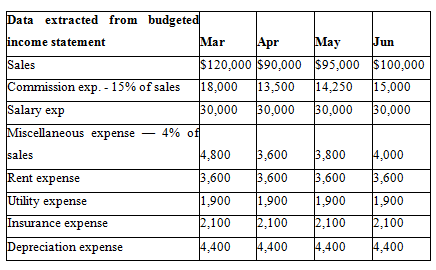

Craig Manufacturing Company's budgeted income statement includes the following data:

| Data extracted from budgeted income statement | Mar | Apr | May | Jun |

| Sales | $120,000 | $90,000 | $95,000 | $100,000 |

| Commission exp. - 15% of sales | 18,000 | 13,500 | 14,250 | 15,000 |

| Salary exp | 30,000 | 30,000 | 30,000 | 30,000 |

| Miscellaneous expense ? 4% of sales | 4,800 | 3,600 | 3,800 | 4,000 |

| Rent expense | 3,600 | 3,600 | 3,600 | 3,600 |

| Utility expense | 1,900 | 1,900 | 1,900 | 1,900 |

| Insurance expense | 2,100 | 2,100 | 2,100 | 2,100 |

| Depreciation expense | 4,400 | 4,400 | 4,400 | 4,400 |

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

How much is the total of the budgeted cash payments for operating expenses for the month of April?

A) $54,200

B) $53,250

C) $54,400

D) $53,900

Craig Manufacturing Company's budgeted income statement includes the following data:

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

How much is the total of the budgeted cash payments for operating expenses for the month of June?

A) $54,200

B) $53,250

C) $54,400

D) $53,900

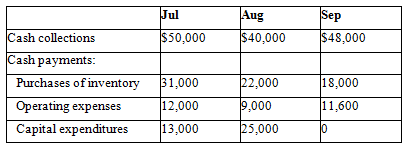

AAA Company is preparing its 3rd quarter budget and provides the following data:

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

How much cash shortfall will the company have at the end of July, before financing?

A) $2,000

B) $6,500

C) $5,000

D) $1,250

Operating Expenses Budget Variable operating expenses: Misc. expense (10% of sales) Total variable expenses Fixed operating expenses: Salary expense Rent expense Depreciation expense Misc. expense (fixed portion) Total fixed expenses Total operating expenses Jul $10000 10000 12000 8000 5600 4200 29800 39800 Aug $12000 12000 12000 8000 5600 4200 29800 41800 Sep $16000 16000 12000 8000 5600 4200 29800 45800 Data extracted from budgeted income statement Sales Mar Apr May Jun $120,000 $90,000 $95,000 $100,000 18,000 13,500 14,250 15,000 30,000 30,000 30,000 30,000 Commission exp. - 15% of sales Salary exp Miscellaneous expense 4% of sales Rent expense Utility expense Insurance expense Depreciation expense 4,800 3,600 3,800 4,000 3,600 3,600 3,600 3,600 1,900 1,900 1,900 1,900 2,100 2,100 2,100 2,100 4,400 4,400 4,400 4,400 Cash collections Cash payments: Jul $50,000 Purchases of inventory 31,000 Operating expenses 12,000 Capital expenditures 13,000 Aug $40,000 22,000 9,000 25,000 Sep $48,000 18,000 11,600 10

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

To solve the questions regarding operating expenses and net income lets break down each question separately Argyle Company Total Operating Expense for ... View full answer

Get step-by-step solutions from verified subject matter experts